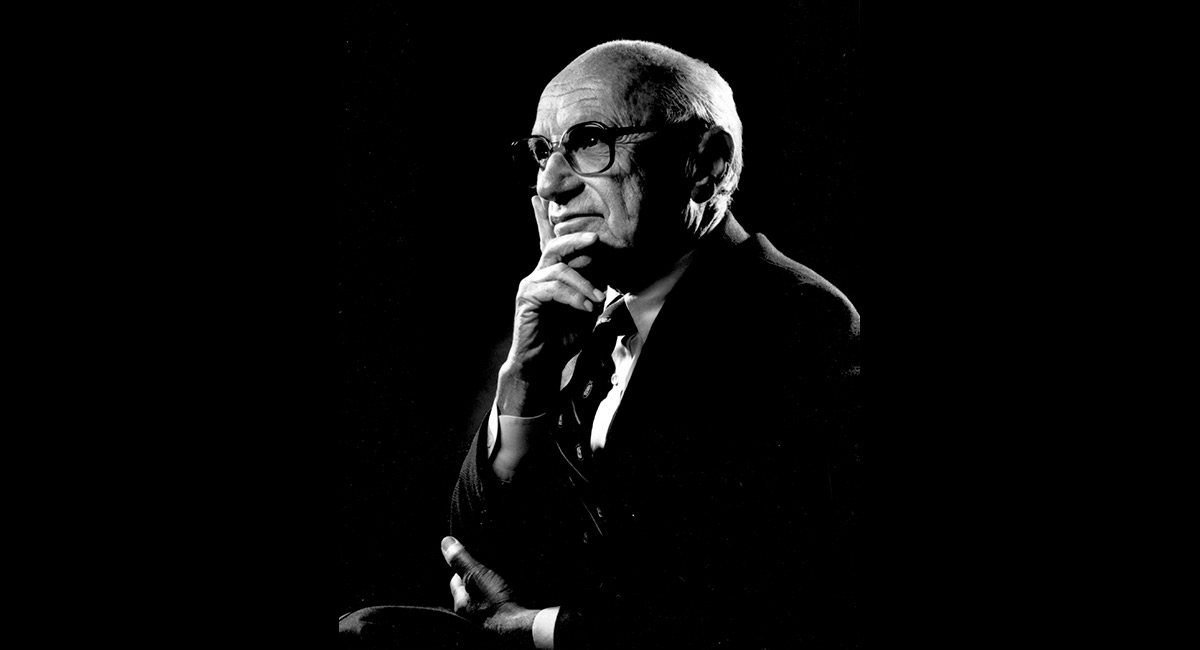

“Milton Friedman is a scholar of first rank whose original contributions to economic science have made him one of the greatest thinkers in modern history.”

—President Ronald Reagan

“How grateful I have been over the years for the cogency of Friedman’s ideas which have influenced me. Cherishers of freedom will be indebted to him for generations to come.”

—Alan Greenspan, former Chairman, Federal Reserve System

“Right at this moment there are people all over the land, I could put dots on the map, who are trying to prove Milton wrong. At some point, somebody else is trying to prove he’s right That’s what I call influence.”

—Paul Samuelson, Nobel Laureate in Economic Science

“Friedman’s influence reaches far beyond the academic community and the world of economics. Rather than lock himself in an ivory tower, he has joined the fray to fight for the survival of this great country of ours.”

—William E. Simon, former Secretary of the Treasury

“Milton Friedman is the most original social thinker of the era.”

—John Kenneth Galbraith, former Professor of Economics, Harvard University

“There are various ways to describe Friedman’s influence. But one way is to ask, ‘Has he helped many people—poor people in the world?’ And I would just take India and China, 37% of the world’s population. Hundreds of millions of people in these two countries, who used to live on less than one dollar a day or two dollars a day, are now able to live at a much more decent standard of living as a result of the reform of their economic policies toward more free-market policies, less regulation, less government and the like. There was one person who they are more indebted to than anybody else for their great improvement in their situation. In my judgment, that person is Milton Friedman.”

—Gary S. Becker, Nobel Laureate in Economic Science

Economist and former Newsweek columnist Henry Wallich has credited Milton Friedman with having “almost single-handedly” changed economic thinking on the subject of money.1 Indeed, Milton Friedman, the 1976 Nobel Laureate in Economic Science, was a world-renowned economist and an academician of the finest caliber. But he was much more. He was an articulate and persuasive advocate of individual freedom, and the private property, voluntary exchange economy, which is based upon and sustains that freedom. British Prime Minister Margaret Thatcher has stated, “Professor Friedman is usually referred to as a monetarist, but his basic belief is not in money. It’s in people’s inherent right and ability to choose how they will live.”

Milton Friedman was born in Brooklyn, New York. His parents, Sarah Ethel (Landau) and Jeno Saul Friedman, were poor immigrants born in Carpatho-Rumania, then a province of Austria-Hungary and later to become part of the Soviet Union. When he was but a year old, the family moved to Rahway, New Jersey, where both his mother and his father were merchants.2

Friedman graduated from Rahway High School in 1928 and worked his way through Rutgers University, studying under Arthur Burns and Homer Jones. Burns shaped his understanding of economic research, and Jones introduced him to rigorous economic theory. Intending to become an actuary, Friedman initially specialized in mathematics, but shortly developed an even stronger interest in economics. He eventually majored in both fields, graduating in 1932. On Jones’s recommendation, the Department of Economics at the University of Chicago offered Friedman a graduate scholarship, which he accepted over a scholarship in applied mathematics at Brown University.3

In 1932, Friedman began graduate work at the University of Chicago, studying under such renowned economists as Frank Knight, Jacob Viner, and Henry Simons, who were in the process of forming what later came to be called the “Chicago School of Economics.”4 The Chicago School has since revolutionized the economics profession by its exacting use of empirical analysis and its rigorous and creative application of microeconomics throughout economic research and in fields once considered independent, such as law, sociology, history, and others.

While at Chicago, in the midst of the depression, Milton Friedman met Rose Director, sister of the distinguished economist, Aaron Director. They were married six years later.

After receiving his M.A. in economics in 1933, Milton Friedman accepted an attractive fellowship at Columbia University where, under Howard Hotelling, he acquired training in mathematical economics and statistics. After one year, he returned to Chicago to assist Henry Shultz, who was then completing his classic, The Theory and Measurement of Demand. From 1935 to 1937, he was an economist with the National Resources Planning Board in Washington, D.C., and in the fall of 1937, Friedman joined Simon Kuznets in the latter’s studies of professional income at the National Bureau of Economic Research.

From 1940 to 1941, Friedman briefly returned to academia as a visiting professor of economics at the University of Wisconsin.5 He spent 1941 to 1943 at the U.S. Department of Treasury working on wartime tax policy, during which time he testified before Congress in favor of establishing Income Tax Withholding, an effort he would later regret. And from 1943 to 1945, he served as a mathematical statistician working on problems of weapon design at Columbia University.6

In 1945, at the University of Minnesota he joined George Stigler, who was later to become a fellow Nobel laureate. A year later, he was appointed associate professor of economics at the University of Chicago.

After completing his Ph.D. at Columbia in 1946, Friedman reworked his dissertation on professional licensure into a book co-authored with Kuznets, Income from Independent Professional Practice.7 He then agreed to take responsibility for research into the role of money in the business cycle for the National Bureau of Economic Research.8

He spent the fall of 1950 in Paris as a consultant to the U.S. Marshall Plan. From 1953 to 1954, he was a Fulbright visiting professor at Cambridge University, where the economics faculty was deeply divided over Keynesian policies.9 In 1956, he edited a collection of essays published as Studies in the Quantity Theory of Money. His introductory essay for that volume, “The Quantity Theory: A Restatement,” resurrected the quantity theory as a viable alternative to Keynesian orthodoxy. With that he eventually became known as the “father of monetarism,” the school of economics that believes the amount of money in circulation is the dominant factor in the determination of nominal aggregate demand.

In 1959, his seminal work, A Theory of the Consumption Function, was published. This volume, which distinguishes between permanent and transitory income, together with his 1961 paper co-authored by David Meiselman, “The Relative Stability of Monetary Velocity and the Investment Multiplier in the United States,” stirred a profound controversy in the economics profession.10

Friedman’s research into the long, unpredictable lags between changes in the money supply and changes in real economic activity and inflation led him to conclude that the only macroeconomic policy that will consistently yield desirable results is a slow, steady, predictable rate of growth of the money supply. This prescription, “monetarism,” was implemented to a great extent in Japan and Germany, and those countries experienced lower rates of unemployment and inflation than countries whose monetary authorities have attempted otherwise. And initially begun under Paul Volcker during the Reagan Administration and continued by Alan Greenspan, monetarism has generally been the policy of the Federal Reserve System in the United States, producing low inflation rates since the early 1980s. However, as Friedman notes, he came to waiver on his strict monetary rule as a result of the Greenspan use of discretion:

I have long favored the use of strict rules to control the amount of money created. Alan [Greenspan] says I am wrong and that discretion is preferable, indeed essential. Now that his 18-year stint as chairman of the Fed is finished, I must confess that his performance has persuaded me that he is right—in his own case. His performance has indeed been remarkable. There is no other period of comparable length in which the Federal Reserve System has performed so well. It is more than a difference of degree; it approaches a difference of kind.11

Throughout the 1950s Friedman stayed clear of partisan politics and concentrated on his work in positive, neoclassical economics. However, in 1962, with the help of Rose Friedman, he published his first major book in political philosophy and political economy, Capitalism and Freedom, based on a series of lectures he had presented. In addition, he took an active interest in the highly influential, classical-liberal journal, The New Individualist Review, edited by then University of Chicago, libertarian, junior scholars Ralph Raico and Ronald Hamowy. Both completed their Ph.D.s under Nobel Laureate economist Friedrich A. Hayek who was then at the Committee on Social Thought.12

In 1963, his magnum opus (with Anna J. Schwartz), A Monetary History of the United States, 1867-1960, was published. This book more than any other forced the economics profession to take monetarism seriously. Friedman and Schwartz assembled convincing evidence in support of the view that all major macroeconomic crises in American history, especially the Great Depression, were caused by substantial monetary shocks. Government, not the free market, caused (and perpetuated) the Great Depression!

Friedman’s analysis of the roles of information costs and inflation expectations in labor markets and his hypothesis of a natural rate of unemployment undermined one of the major pillars in the Keynesian orthodoxy—the Phillips curve. Because of Friedman’s work and the work of others he inspired, by the late 1970s, it could reasonably be said that true Keynesians no longer existed.

In all, Friedman was the author or co-author of more than 20 books and of roughly 100 scholarly papers for professional journals, plus numerous other articles and reviews for a wide range of popular publications. He was the Paul Snowden Russell Distinguished Service Professor of Economics at the University of Chicago until his retirement from active teaching in 1977, when he joined the Hoover Institution at Stanford University as a senior research fellow. For many years later, he continued as a member of the research staff at the National Bureau of Economic Research, and he was a contributing editor and columnist for Newsweek magazine, replacing Henry Hazlitt, from 1966 to 1983.

Like his friend and sometime sparring rival from the anti-positivist, market-process-based Austrian School of economics, F.A. Hayek, Friedman was a classical liberal who did not accept the label “conservative” because of his view that it connotes blind acceptance of the past. He clearly perceived and taught the interdependence of economic freedom with the civil liberties of free speech, worship, press, assembly, and so forth. Consequently, he was one of the most eloquent and persuasive advocates of the economic and ethical superiority of free markets over collectivist government control.

In the course of his defense of individual freedom, Friedman was the architect or advocate of many influential and ingenious proposals to resolve critical public issues, while at the same time dismantling government bureaucracy. Among his proposals were the following:

Negative Income Tax: To eliminate the massive welfare system’s disincentives and enormous waste, abolish all welfare programs and replace them with a program of direct cash payments to those actually in need simply by adding a new income tax bracket (one for negative values of taxable income) to the tax code.Educational Vouchers: To provide a competitive climate for public and private education, all parents of primary and secondary school children would be issued government vouchers to be spent at the school of their choice. Government’s only role would be to provide the vouchers; competition for clients would assure quality and innovation.

Flat Income Tax: To streamline the tax system and to lower its enormous direct costs to the general public and the indirect inefficiencies imposed on the economy, abolish the corporate income tax. In addition, tax individuals only at a non-progressive, low, flat rate, raising personal exemptions to some minimum income level, and ending all loopholes.

Stable Money Growth: To eliminate the recurring problems of inflation, unemployment, and decreased productivity, abolish the Federal Reserve System, legalize private monies, and peg the increase of the government money supply to the growth in GNP, perhaps 0 to 3 percent per year.

Floating Exchange Rates: To solve the nation’s balance-of-payments problems and to open the possibility of unilaterally eliminating anti-consumer protectionist measures, abolish exchange controls and let national and private currencies seek their own price levels in the market.

Balancing the Budget: Since deficit spending is simply a device for hiding tax increases, thereby lowering taxpayer resistance to government spending and impairing economic growth, all government spending should be handled according to the merits of each specific proposal in a pay-as-you-go basis. Fiscal policy should never be used to affect business cycles, and the Balanced Budget Amendment should be adopted.

Volunteer Army: To create a more efficient, better motivated, and morally tenable defense system, abolish the compulsory servitude of the draft and draft registration and maintain a voluntary system of enlistment based on competitive benefits and professional, career-oriented training.

No Victimless Crime Laws: To direct limited police and legal resources to the problems of violent crime, eliminate all laws creating “crimes with no victims.” More specifically, where consent is present between two or more adults no criminal injustice can be possible; hence, for Friedman government has no place in proscribing or regulating such areas as prostitution, profanity, pornography, drugs, and so forth. In this regard, Friedman was not condoning any such behavior, but instead noting that these and all non-invasive matters are best regulated by property owners via private-property agreements and institutions, as opposed to government command-and-control. Moreover, Friedman agreed with the late Harvard philosopher Robert Nozick’s position that such practices should be equally legal along with all “capitalist acts between consenting adults.”13

As a result of his devotion to individual freedom, Friedman was an early and vocal supporter of California’s Proposition 13 to reduce property taxes across-the-board, as well as President Ronald Reagan’s original proposal to cut individual and corporate income tax rates. He was opposed to price controls, farm subsidies, securities and exchange controls, tariffs, and, in fact, all government interventions into the peaceful pursuits of individuals. To Friedman, government’s role should be stringently restricted to defending the nation from foreign enemies, defending persons from force and fraud, providing a forum for decisions of the general rules determining property and similar rights, and providing a means to mediate disputes about the rules.

Perhaps Friedman’s greatest success began in 1979 when he and his wife Rose authored the book, Free to Choose, based on the famous ten-part TV series for PBS by the same title. Both the TV program and the book were drawn from an earlier series of lectures presented by Friedman. Because it aired during a period of critical economic distress during the Carter Administration and in the aftermath of the Vietnam War, Watergate scandal, and Richard Nixon’s resignation as President, the program is widely regarded as being a major factor in shifting American public opinion toward appreciating the need to dismantle government largess. The series was shown in England, Japan, Italy, Australia, Germany, Canada, and many other countries, and the book was translated for distribution around the world, selling more than one million copies.

As a result of his impact on academic and public opinion, Friedman was an economic advisor to 1964 Republican presidential candidate Barry Goldwater; Presidents Ronald Reagan, Gerald Ford, and Richard Nixon; as well as British Prime Minister Margaret Thatcher. But throughout this time, he consistently turned down full-time positions in government, preferring to continue his scientific work and leave public activities to full-time policymakers.

In addition, Friedman’s ideas were critically influential in the economic liberalization reforms in such countries as Estonia, Chile, Ireland, China, New Zealand, Czech Republic, and India. In the process, he was accused of complicity in the repressive regimes of Chilean dictator Augusto Pinochet and in Communist China. However, Friedman maintained that in advising any government, in no way was he supporting any policies that run counter to the principles of individual liberty. Indeed, he indicated that he instead sought to end all policies of oppression.

In short, Friedman believed that government’s sole functions should be to provide civil policing and justice plus national defense. For the latter however, he went further than merely supporting the protection of national borders from invaders. In the aftermath of World War II, Friedman became a supporter of the Cold War and the Wilsonian legacy of U.S. military interventionism around the world. This led him to support the Vietnam War and other overt and covert U.S. policies. However, in the process, he noted that, “I’m anti-interventionist, but I’m not an isolationist,”14 and upon reading the 1987 landmark book by Independent Institute Senior Fellow Robert Higgs, Crisis and Leviathan, which shows that war “crises” are the major engine of the very neo-mercantilism and Big Government he long opposed, Friedman became an increasing critic of “wars of choice,” including the war in Iraq.

The Friedman’s were married for 68 years and had two children: David, who teaches law and economics at Santa Clara University, and Janet, who practices law in California.

To recognize the enormous contributions of this man, I had the distinct pleasure and privilege to organize the gala National Dinner to Honor Milton Friedman on October 4, 1983, at the Fairmont Hotel in San Francisco, at which then struggling actor Arnold Schwarzenegger, who had been inspired by the “Free to Choose” TV series, first met Friedman in person.

In addition to the Nobel Prize, Friedman was the recipient of the Grand Cordon of the First Class Order of the Sacred Treasure of Japan (1987), National Medal of Science (1988), and Presidential Medal of Freedom (1988), and he was a member of the American Philosophical Society and the National Academy of Sciences.

In 1998, Milton and Rose Friedman penned their autobiography, Two Lucky People: Memoirs, which traces their remarkable personal journey and life experiences, and they both spent recent years working together pursuing their dream of educational choice for all parents throughout the U.S.

Milton Friedman died on November 16, 2006, from heart failure, in San Francisco. Unlike any other intellectual figure of the twentieth century, he transformed public debate away from the suicidal path of command economies and toward economies based on individual choice, free markets, and personal responsibility. Friedman was brilliant, creative, resilient, and effective. In his career, including the thirty years that I had the pleasure of knowing him, he was a champion who sought to facilitate greater opportunity for all, especially those most in need. In economics, education, finance, business, civil liberties, welfare, and a host of other areas, he has left a powerful legacy for the benefit of humanity.

Notes

1. John Davenport. “The Radical Economics of Milton Friedman,” Fortune, 1 June 1967, p. 131.

2. “Milton Friedman,” Current Biography 1969 (Bronx, NY: H.W. Wilson Company), p. 151.

3. “Milton Friedman,” Les Prix Nobel en 1976 (Stockholm: The Nobel Foundation, 1977), p. 239.

4. Karl Brunner. “The 1976 Nobel Prize in Economics,” Science 194 (November 5, 1976), p. 595.

5. Current Biography, p. 152.

6. Les Prix Nobel en 1976, pp. 240-41.

7. Current Biography, p. 152.

8. Les Prix Nobel en 1976, p. 241.

9. Ibid.

10. Current Biography, p. 152.

11. Milton Friedman. “He Has Set a Standard.” Wall Street Journal (June 31, 2006).

12. Milton Friedman. “Introduction.” New Individualist Review (Indianapolis: Liberty Press, 1981), pp. ix-xiv.

13. “Portrait: Milton Friedman,” Challenge (May-June 1978), p. 69; Milton Friedman, Capitalism and Freedom (Chicago: University of Chicago Press, 1962); and Milton and Rose Friedman, Free to Choose (New York: Harcourt Brace Jovanovich, 1980).

14. “Best of Both Worlds: Milton Friedman reminisces about his career as an economist and his lifetime ‘avocation’ as a spokesman for freedom,” Reason (June 1995).