In a previous book review for The Independent Review, I distinguished between two broad camps of Austrian economists. “Freshwater” Austrians follow in the footsteps of Murray Rothbard and are typically associated with the Ludwig von Mises Institute in Auburn, Alabama. “Saltwater” Austrians take inspiration from Hayek, Kirzner, and Lachmann to varying degrees and usually have connections to George Mason University in Fairfax, Virginia or New York University.

A Research Agenda for Austrian Economics collects nine essays written primarily by Saltwaters who are mostly less than two decades out of graduate school. It is co-edited by the late Steven Horwitz and Louis Rouanet. Reviewing this book gives me the opportunity to indulge one of my favorite vices: creating simplistic taxonomies of types of economics. The collection of essays here gives a peek into how Saltwater Austrian economics has evolved over the past two decades, especially at George Mason. It is not one monolithic enterprise but rather a set of interrelated research agendas.

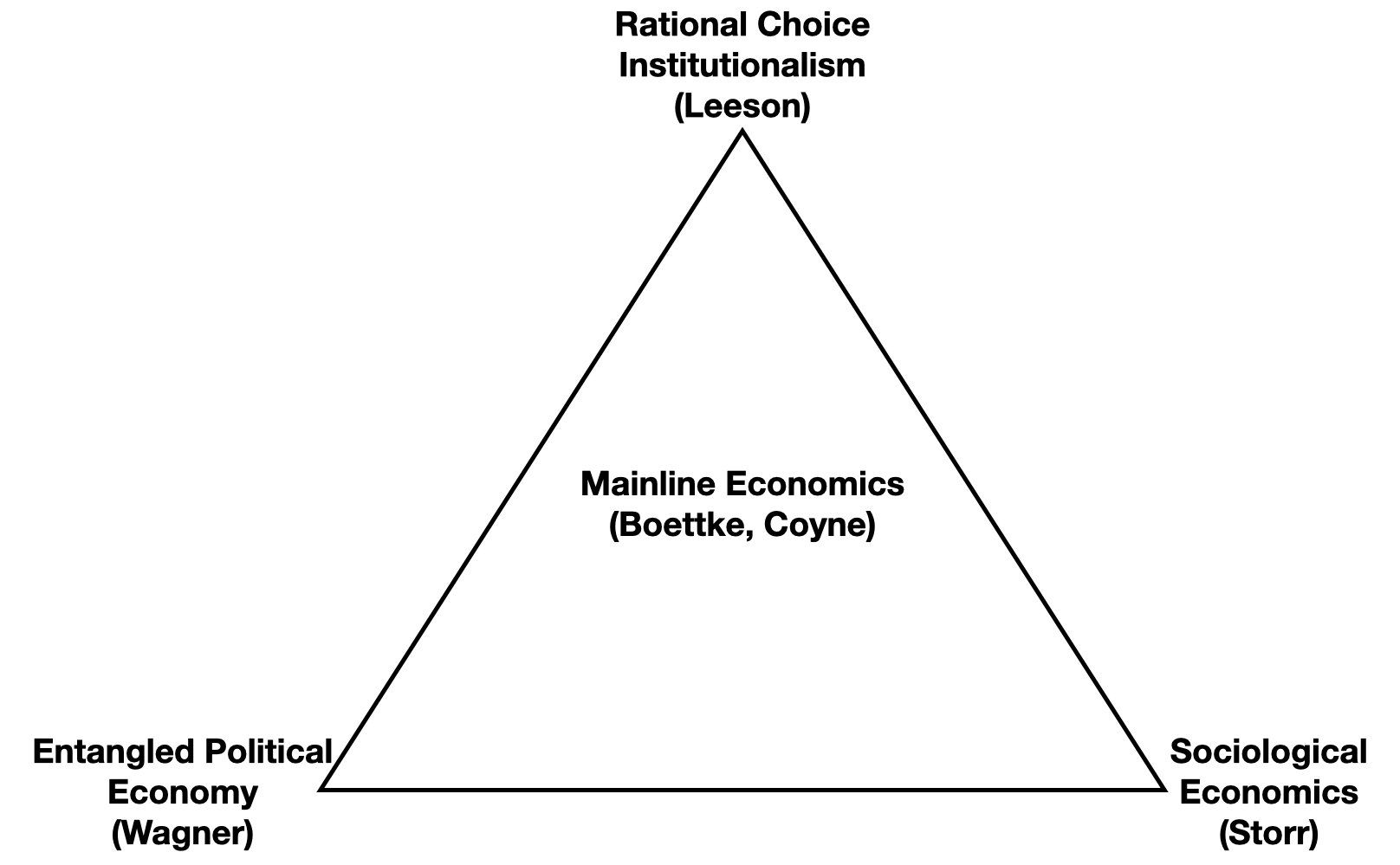

Figure 1 presents what I consider to be the main streams of work that current Saltwaters are producing, as well as the George Mason scholars I most closely associate with each stream. The placement of the three vertices is arbitrary: they imply neither a position in conceptual space nor relative distances. All that it is meant to convey is that the stream labeled “Mainline Economics” is more central to the Saltwater identity than the others, but they all have a claim to be contributions to Austrian economics. In order to draw out some common themes, I group my comments on the chapters according to where I would place them in the figure.

I will begin with Sociological Economics, because those chapters are the easiest to summarize: there are none in this volume. However, any picture of contemporary Saltwater research would be incomplete without pointing to this body of work. It emerged in large part from the Mercatus Center’s research project examining the aftermath of Hurricane Katrina, and is best embodied in the work of Virgil Storr. The scholars who work in this field refer to it as Economic Sociology, which is not incorrect, but I have inverted the phrasing to emphasize what is distinct about the George Mason approach. Saltwater Sociological Economists import concepts from sociology to flesh out the different means by which individuals respond to the sort of radical ignorance and uncertainty that Austrians emphasize. Norms, social networks, culture, and ideologies all provide points of orientation for individuals in a complex and ever-changing world. Qualitative methods, including ethnography, interviews, and even community, are used to map how these social phenomena guide and are reshaped by individual and collective action.

Rational Choice Institutionalism is best exemplified in the prodigious work of Peter Leeson and his students. The core idea is straightforward: the rules that people live by are both constraints on human action and the results of human action. Economics should examine both the origins and consequences of institutions, and it should do so on the assumption that they reflect rational solutions to the problems confronted by the people that create said institutions. Otherwise, the institutions would be changed. In order to endure, institutions must align individual incentives so that they are compatible with the patterns of actions that constitute said institutions. This orientation toward accounting for historical practices makes the Rational Choice Institutionalists the most comfortable with comparative statics and traditional econometric methods, though they also frequently make use of qualitative evidence to construct analytic narratives.

Louis Rouanet’s introduction to the volume most clearly embodies this approach. He outlines five pitfalls for Austrian economists doing applied work: meta-theorizing, misguided realism, neglecting theory, behavioralism, and adopting insulating strategies that lead Austrians to avoid trying to influence the wider profession. He avers that signature Austrian concepts such as spontaneous order, while theoretically sound, do not themselves produce insight into empirical phenomena. Economists should freely use unrealistic equilibrium models to generate hypotheses and use theory to sort out which of people’s subjective beliefs can in fact account for observed patterns of behavior.

Entangled Political Economy has emerged as the banner under which a variety of Austrian and Austrian-esque critiques of standard neoclassical economics have rallied. Richard Wagner coined the term, which is meant to draw attention to the fact that markets and states are not monolithic, separate spheres of activity that exert influence on one another. Rather, enterprises operating by the rules of the private sector are entangled in relationships of conflict, cooperation, and competition with a complicated variety of enterprises operating by the rules of the public sector. This approach to political economy draws inspiration from complexity economics, the Italian public finance tradition, systems theory, theories of spontaneous order from Adam Smith to F.A. Hayek, and James Buchanan’s more Austrian forays into public choice and public economics.

Marta Podemska-Mikluch’s chapter investigates the relationship between Entangled Political Economy and Erwin Dekker’s characterization of the pre-World War II Austrian school as the “Viennese Students of Civilization.” One of the defining features of Entangled Political Economy is that it is focused on the generation of structured patterns of human interaction, rather than only on whether existing practices are incentive compatible. Podemska-Mikluch argues that the Viennese Students have a similar orientation. Moreover, both approaches emphasize the interconnectedness between what are often treated as distinct social spheres: economics, social and cultural norms, and politics. They also both place great emphasis on the epistemic limits of the mind to grasp complex orders and the internal vulnerabilities of liberal civilizations. This chapter does an admirable job giving an accessible introduction to a complicated body of work.

Mainline Economics blends the market process theory of Ludwig von Mises, F.A. Hayek, and Israel Kirzner with analytical tools from thinkers such as Armen Alchian, James Buchanan, Ronald Coase, Harold Demsetz, Elinor Ostrom, Vernon Smith, and Gordon Tullock. The term was popularized by Peter Boettke in Living Economics: Yesterday, Today, and Tomorrow (Oakland, Calif.: Independent Institute, 2012). These thinkers find the explanation of invisible hands and spontaneous orders in the coordinating function of property, money, contract law, social norms, and other institutions. It is the most central approach to contemporary Austrian economics not only sociologically, but also because it borrows most freely from the other approaches. Mainline Economics embraces rational choice, but also entrepreneurship and sheer ignorance; embeddedness, but also incentives; and spontaneous order, but also price theory.

Three chapters most fully embody the Mainline approach. I will focus on two of them. Abigail Hall’s contribution also falls squarely into the Mainline Economics genre, offering a helpful survey of her work (much of it joint with Chris Coyne) on the economics of defense. I omit a detailed discussion of this work primarily because it is the mostly likely to be familiar to the audience of this journal, because it is obviously Mainline Economics as I have defined the approach, and because it is so compelling as to need no additional advertising.

Michael and Diana Thomas discuss the relationship between knowledge problems and incentive problems confronting regulators. The economics analysis of regulation typically takes its orientation from Arthur Cecil Pigou’s classic analysis of externalities, which eventually developed into market failure theory in the mid-twentieth century. The standard critique of the standard approach is rooted in the work of property rights economics (such as that developed by Ronald Coase and Harold Demsetz) and public choice economics. This long tradition argues that courts are often better incentivized than regulators to deal with market failures.

Thomas and Thomas contend that this approach is incomplete without acknowledging the sorts of knowledge problems that Austrian economists emphasize. Accounting only for incentives leaves the standard critique vulnerable to the modern “enforcement theory” of regulation developed by Edward Glaeser and Andrei Shleifer (“The Rise of the Regulatory State,” Journal of Economic Literature 41, no. 2, 401–425). This rejoinder to the property rights and public choice approach concludes that regulation, despite its flaws, is often a constrained optimum in light of the ability of large corporate interests to subvert the legal system. Thomas and Thomas argue that this conclusion is too hasty, because regulators also confront knowledge problems that limit their ability to identify efficient regulations. Using their prior work on blood market regulation as an illustration, they conclude that the rivalrous processes of market and legal competition would have been better suited to make blood donations safe than the regulatory regime that was imposed by concerns about the transmission of hepatitis.

Rosolino Candela and Vincent Geloso’s assessment of public goods theory also takes a mainly Mainline approach. Public goods are non-rivalrous (able to be simultaneously consumed by large numbers of people) and non-excludable (making charging for their provision difficult). They draw on Don Lavoie’s interpretation of the socialist calculation debate. Lavoie argues that neoclassical market socialists, since they were reasoning from general equilibrium, simply assumed that market socialist prices reflect relative scarcities and thus can serve as effective guides to resource allocation. This approach ignores the rivalrous process of competition by which market prices come to reflect relative scarcities.

Similarly, Candela and Geloso claim, the standard approach to public goods assumes the publicness of certain goods that is an outcome a rivalrous process. They illustrate this claim with two examples. The provision of the rule of law can be thought of as a public good, but so is the creation of a state that can provide the rule of law. They cite various historical studies arguing that the ability of states to provide the rule of the law was a product of competitive processes that placed constraints on the ability of states to engage in predation. The second example draws on Candela and Geloso’s previous work on lightships, which were a privately provided substitute to lighthouses. The excludability of a good, they argue, is the endogenous outcome of a process of rivalrous competition rather than a fixed feature of certain classes of goods.

Other chapters in the volume tend to fall somewhere within but not on the vertices of the triangle in figure 1. For instance, Bryan Cutsinger makes the case that standard accounts of Austrian Business Cycle Theory give short shrift to the expanded powers of the U.S. Federal Reserve Bank following the 2008 financial crisis, in particular the Fed’s change to paying interest on bank reserves. This is a compelling chapter, but could have been improved by comparing how contemporary Fed policies differ from those of other central banks in advanced economies. It would fall somewhere between Mainline Economics and Rational Choice Institutionalism, depending on how central one considers the concept of entrepreneurial error to be to Austrian Business Cycle Theory. David Lucas offers a helpful literature review on the influence of contemporary Austrian economics in business school entrepreneurship literature, and Peter Lewin and Nicolas Cachanosky present another overview of their innovative integration of concepts from financial accounting and Austrian capital theory.

Are these different approaches in conflict? It depends on who you ask. I would like to suggest that, at a minimum, they might serve different purposes. Rouanet’s chapter strikes about the right tone when advising Austrian economists to embrace some more mainstream practices. But I also think it takes too narrow a view of what counts as applied economics, in that it only really makes room for comparative statics. Comparative statics—comparing one relatively stable set of practices to another—is an incredibly useful way to understand the social world. But sometimes we want to ask different questions, such as: what is the origin of this social practice? Conceptual tools such as entrepreneurship and spontaneous order can assist in this endeavor. These analyses may not result in clean testable hypotheses, but nonetheless count as using economics to understand the real world (James Buchanan, “The Domain of Subjective Economics: Between Predictive Science and Moral Philosophy,” in Israel Kirzner, ed., Method, Process, and Austrian Economics: Essays in Honor of Ludwig von Mises, Lexington, Mass.: D.C. Heath, 1983). There is wide scope, I submit, for Mainline and Sociological Economics contributions to what should be considered applied economics, as Candela and Geloso’s chapter illustrates.

Another use of more distinctively Austrian ideas is in institutional analysis, both in its positive and normative dimensions. Incorporating concepts such as sheer ignorance and emergence helps to both explain the operation of systems of rules and their normative desirability, making both Mainline Economics and Entangled Political Economy empirically relevant. Ennio Piano’s excellent chapter on the relationship between Austrian economics and behavioral economics makes this point very clearly. While much of Piano’s work falls squarely into the category of Rational Choice Institutionalism, he recognizes the importance of knowledge problems when evaluating the desirability of policy proposals derived from behavioral economics (p. 101). Even when distinctively Austrian ideas do not furnish data-testable predictions, they serve as an important guardrail for the application of economic ideas.

The final chapter in this book is a reproduction of Peter Boettke’s remarks from a conference honoring co-editor Steven Horwitz in 2022. Boettke remarks on Horwitz’s thorough knowledge of traditions that have fed into Mainline Economics, his work in Austrian macroeconomics, and his accomplishments as a teacher of economics. This volume is a project that Horwitz had wanted to pursue for a long time (he spoke to me about it over 12 years ago), so I am pleased that Rouanet was able to bring the book across the finish line after Horwitz’s untimely passing. Horwitz always took an interest in giving both advice and opportunities to emerging scholars. This collection stands as a fitting tribute to his legacy as a teacher and contributor to the proud and still fertile tradition of Austrian economics.

| Other Independent Review articles by Adam G. Martin | ||

| Summer 2023 | A Modern Guide to Austrian Economics | |

| Fall 2022 | Essays on Austrian Economics and Political Economy | |

| Summer 2019 | The Mantle of Justice | |

| [View All (5)] | ||