The Independent Institute recognizes and honors the many benefactors who have made enduring gifts by including Independent in their financial or estate planning.

To ensure that the principles you value endure for future generations, your legacy gift will carry the torch for human freedom and dignity, allowing your family and future generations the opportunity to flourish as you have.

There are several ways that you can make a lasting and significant gift to Independent and the future of liberty and free societies.

- You may simply designate the Independent Institute as a charitable

beneficiary in your will or retirement plan. Any assets accordingly distributed to Independent are exempt from

estate tax. You can leave a bequest to the Independent Institute by

adding to an existing will or drafting a new one. You can also make

a future gift of retirement-plan assets by designating Independent as

the beneficiary of your plan.

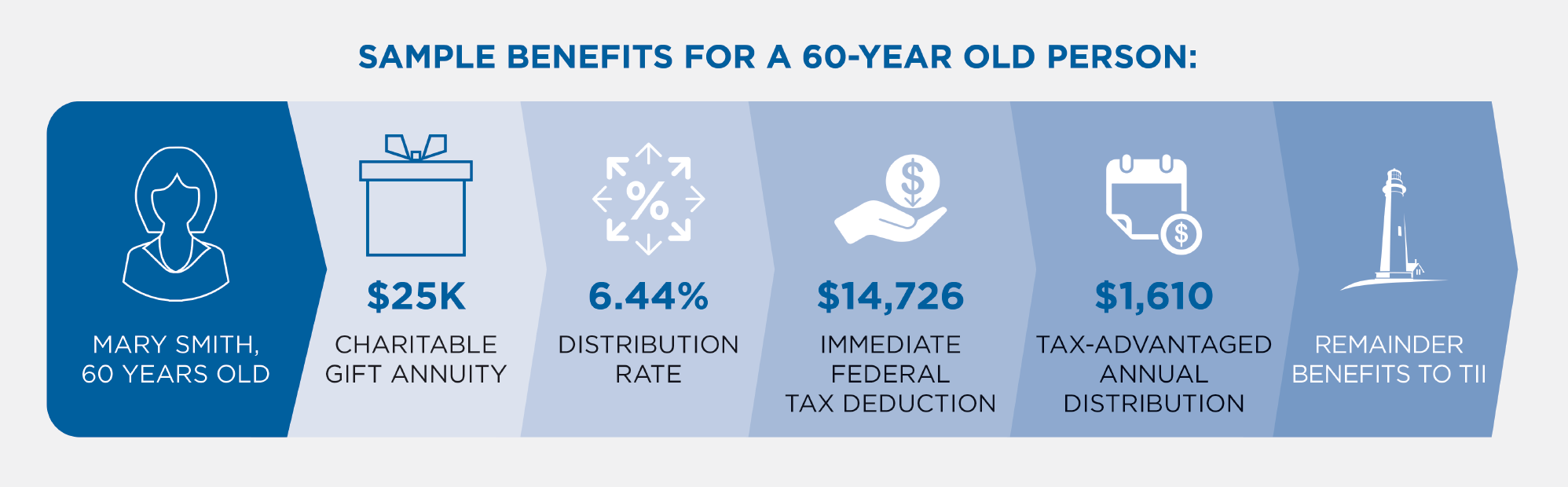

- Our Legacy Income Trust fund provides an immediate tax deduction, plus tax-advantaged income for your lifetime (with the option to add income for the life of a designated survivor).

Joining the Safe Harbor Legacy Society will help inspire young people today and for generations to come.

Please contact us for a customized illustration based on your age, tax bracket, and the amount being considered as a legacy gift.