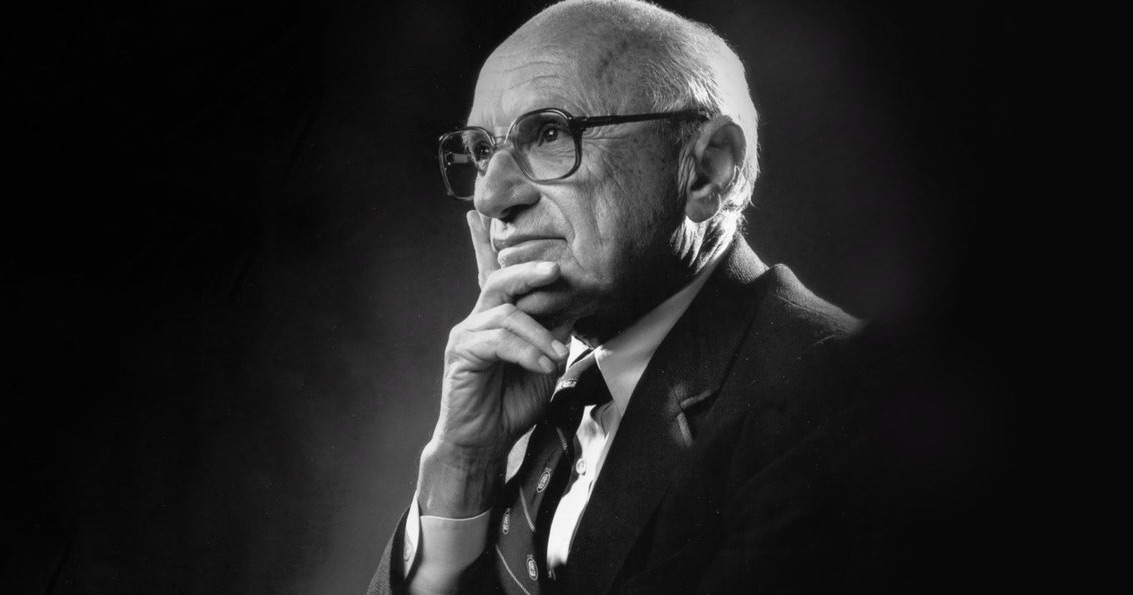

Milton Friedman has been an ardent and effective advocate for free enterprise and monetarist policies for five decades. He was born in Brooklyn, N.Y., in 1912, the son of Jewish immigrants who had come to America in the late 1890s. He attended public schools, then entered Rutgers University in 1928. Being away from home for the first time gave Friedman important early work experiences, as well as insights into entrepreneurship and the business processes of the market economy (Friedman and Friedman 1998, 25–27).

Originally a math major, Friedman switched to economics in his third year at Rutgers, a decision that brought him into the classrooms of two men who would guide his later life: Homer Jones and, especially, Arthur F. Burns. Burns later became a fixture at the National Bureau of Economic Research (NBER), one of the nation’s foremost authorities on business cycles and, ultimately, chairman of the Federal Reserve Board of Governors (1970–78). Burns led Friedman to begin an appreciation of what good scholarship entailed and introduced the young economist to the works of Cambridge School of Economics founder Alfred Marshall. Jones, a pivotal figure in the monetarist camp, introduced Friedman to Frank Knight and the early Chicago school, especially Knight’s Risk, Uncertainty, and Profit.

After Friedman received his undergraduate degree from Rutgers, Jones arranged a scholarship for him to study economics at the University of Chicago, where Friedman received an M.A. in 1933. During that year in Chicago, he also met his future wife, fellow economics student Rose Director, who became an active partner in his professional work. He continued his graduate study at Columbia University and completed his Ph.D there in 1946.

While at Columbia, Friedman met and was influenced by other famous economists, including John Maurice Clark, Harold Hotelling and NBER founder Wesley Clair Mitchell. Friedman was soon working at the NBER as an assistant to Simon Kuznets, famous for developing the national income product accounts and many of the techniques applied to them in the 1920s and ’30s. Because Friedman’s early study in economics involved constant contact with theorists such as Burns, Mitchell and Kuznets, it is not surprising that he became more focused on macroeconomic issues like monetary theory and business cycles than on the microeconomics of Burns’ own favorite, Marshall.[1]

Unable to secure a university appointment because of anti-Semitism and a dearth of openings, Friedman began his career in 1935 in Washington, D.C., during the early days of the New Deal. At the National Resources Committee, he used his statistical acumen to help develop better consumer spending studies so that improved historical data and better price indexes could be developed. Friedman’s knowledge of sampling theory was especially relevant in this undertaking, and his first journal articles resulted from these early efforts.

In the late 1930s, Friedman began collecting and analyzing data on the distribution and size of income, which later figured prominently in what he considers his best work, A Theory of the Consumption Function. In this 1957 book, he for the first time put forth his famous permanent income hypothesis. This explanation for consumption behavior offered an alternative to the theory propounded in John Maynard Keynes’ The General Theory of Employment, Interest, and Money. Friedman’s work showed Keynes’ stable, predictable consumption function is an empirically inaccurate estimator of shortrun, aggregate consumption. Friedman offered his alternative permanent income function, along with a theoretical discussion that plausibly explained why his theory was better. In producing this work, Friedman put into practice a methodology that became the foundation of one of the most cited and attacked—and defended—articles in the history of economics: On the Methodology of Positive Economics (1953, 1–43).

The most controversial contention in this essay is that a theory’s assumptions don’t matter because predictive power is everything. The essay also asserts that a simpler theory is preferable if it predicts a higher number of outcomes—a variation on Occam’s Razor—and that a good theory will “surprise” us by predicting counterintuitive outcomes. A good theory is one that “explains a lot by little” and has been subjected to many attempts at empirical “falsification,” a philosophical stance that Friedman apparently absorbed from Karl Popper.[2] To his credit, and regardless of the correctness of his views on scientific method, Friedman’s own empirical work conforms to his view of the proper way to “do science.”

Friedman contributed to another important effort while in Washington during World War II. At the Treasury Department, he helped create the current federal income tax withholding system. Friedman says he now regrets his role, although at the time he believed the new system was superior to the one it replaced (Friedman and Friedman 1998, 123). Working in Washington gave him great insight and the chance for a firsthand look at how bureaucracies function.

The war brought many changes. For the Friedman family it meant a move to New York City, where Milton joined the Statistical Research Group at Columbia University in 1943. This group worked on a number of war-related issues, from proximity fuses in bombs to the vulnerability of bombers during their runs. Statisticians’ role in the war has generally been overlooked, but their contributions were important, especially as they developed the techniques still used today in modern econometric analysis.

After the war, Friedman spent a year teaching at the University of Minnesota, then took a job at the University of Chicago in 1947 and stayed there until his retirement from teaching in 1977. While at Chicago, he became the leader of the first recognized counterrevolution against Keynesianism. Keynes’ view poses that government could, and should, fine-tune the nation’s macroeconomic performance, simultaneously guaranteeing an end to the business cycle and perpetual full employment.

Friedman, a classical liberal who believes in free markets, opposed this view and the theoretical mechanisms that justified it. He developed the economic paradigm that the University of Rochester’s Karl Brunner named monetarism. Friedman himself disapproves of this “unlovely” term (Friedman and Friedman 1998, 228). Nonetheless, his resurrection of the classical school’s foundation for its monetary theory—the quantity theory—led to the establishment of a demand-side alternative to Keynes for conducting macroeconomic policy. Given Friedman’s position at Chicago, the prestige of its economics department and the ability of his students, it is hardly surprising that monetarism caught on across the nation and became highly influential during the 1960s and ’70s. Monetarism stresses the importance of the quantity of money as an instrument of government policy and as a determinant of business cycles and inflation.

What accounted for this shift in thinking by economists, bankers and politicians who had so fervently argued for Keynesianism for two decades? A series of articles and books and one speech did the trick. The books were Studies in the Quantity Theory of Money (1956) and A Monetary History of the United States (1963). The speech was the presidential address to the American Economic Association in 1967. Its thesis was that the so-called tradeoff between inflation and unemployment, known as the Phillips curve, was not a sustainable, long-run policy option. In the speech, Friedman resurrected the classical notion of real factors determining long-run employment, with monetary changes unable to lower the unemployment rate in the long run. Considered heresy at the time, the natural rate hypothesis—as it has come to be known—is now taught, alongside his permanent income hypothesis, as standard macroeconomic theory.

In 1962, Friedman published a book based on a series of lectures he gave at seminars sponsored by the Volker Foundation. That book—Capitalism and Freedom, cowritten with his wife, Rose—subsequently sold half a million copies in 18 languages and launched Friedman’s career as one of America’s policy intellectuals. His name is known to more Americans than that of any other economist. Contributing to his visibility were his triweekly column in Newsweek magazine (1966–84) and his 10-part PBS program Free to Choose (1980), which complemented a book of the same name cowritten with Rose.

During this period, he also was an adviser to three presidential candidates: Barry Goldwater (unofficially), Richard Nixon and Ronald Reagan. Many policy ideas that emerged from this period bear his stamp: the all-volunteer military, the negative income tax, floating money-exchange rates, the Dutch auction procedure for selling government securities, school vouchers and opposition to wage–price controls. The list is long and impressive, both in its scope and in the original thinking applied to several of these issues. The 1976 Nobel Memorial Prize in Economic Sciences cemented in the public’s mind his position as one of the world’s leading economists. Ironically, Friedman dislikes this publicity aspect of the Nobel Prize (Friedman and Friedman 1998, 443).

After leaving Chicago in 1977, Friedman became a senior fellow at Stanford’s Hoover Institution and moved to San Francisco. Even in retirement, Friedman continues to travel, lecture and write, still in the fray of contested ideas, still expressing his views on current economic and political issues. He will be remembered, of course, for his technical brilliance as an economist. However, like the 19thcentury French economist–journalist Frédéric Bastiat, Friedman’s ability to engagingly and directly communicate economic theory to average people may well be his greatest legacy.

On May 9, 2002, Friedman was honored for lifetime achievements by President George W. Bush, who said during the ceremony, “He has used a brilliant mind to advance a moral vision—the vision of a society where men and women are free, free to choose, but where government is not as free to override their decisions. That vision has changed America, and it is changing the world.”

Federal Reserve Chairman Alan Greenspan, who attended the ceremony, added, “There are many Nobel Prize winners in economics, but few have achieved the mythical status of Milton Friedman.”

Notes

[1] Friedman, Milton (1949), “The Marshallian Demand Curve,” Journal of Political Economy 57 (December): 463–95. He did not ignore Marshall and microeconomics, however. He has written or coauthored many articles on choice under uncertainty and has examined Marshall’s demand function in great detail. Also see, Walters, Alan (1987), “Milton Friedman,” in The New Palgrave: A Dictionary of Economics, vol. 2, ed. John Eatwell, Murray Milgate and Peter Newman (New York: Stockton Press), 426.

[2] Popper, Karl (1968), The Logic of Scientific Discovery (New York: Harper Torchbooks). Two points: Popper was inconsistent in his belief in the inductive problem or its possible solution, and falsification can only work if a theory is formulated in such a way that it can be falsified by empirical evidence.