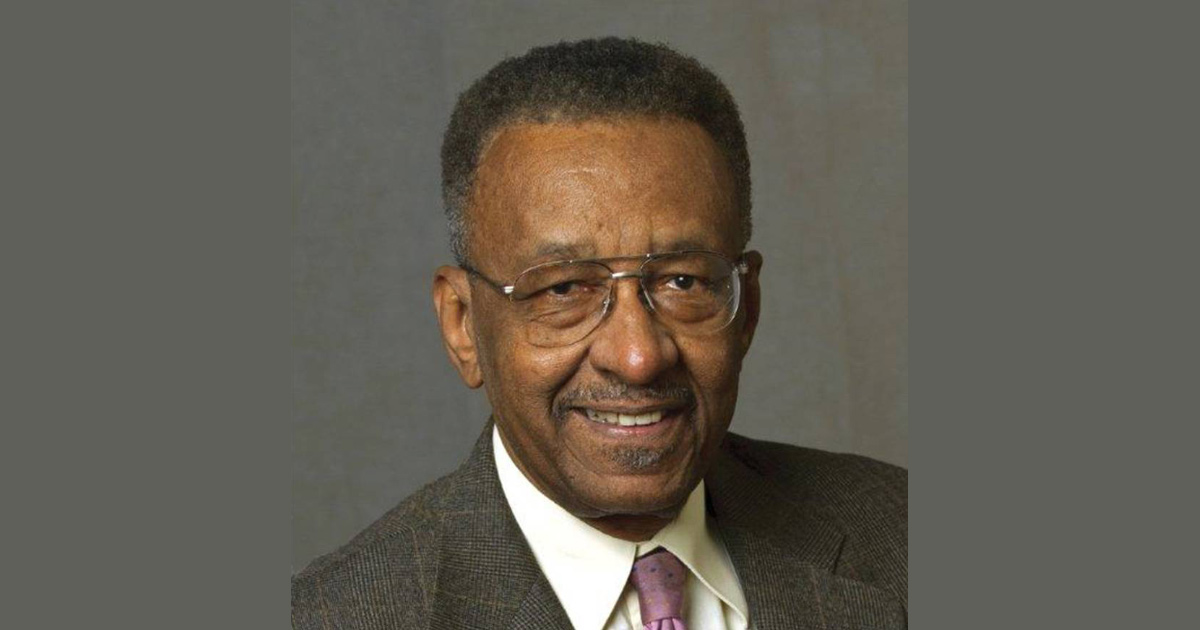

83 years ago today, one of the most forceful and thoughtful defenders of a free society was born. Walter Williams came Up From the Projects—the title of his 2010 memoir published by the Hoover Institution—to earn a PhD in economics at UCLA. The John M. Olin Distinguished Professor of Economics at George Mason University, Williams has had a long and successful career teaching price theory, analyzing the institutions of a free and prosperous society, and writing commentaries for outlets far and wide.

The unintended consequences of government action are central to the classical liberal vision that frames Williams’ scholarship and commentary. In 1982, Williams published The State Against Blacks and in 1985 hosted a PBS documentary based on his book and titled “Good Intentions,” described in its opening as “a personal statement” (and linked below). In it, he argued that even armed with the best of intentions, golden-hearted interventionists had actually harmed precisely the people they wanted to help. It was a theme Thomas Sowell would take up in books like The Vision of the Anointed and The Quest for Cosmic Justice. Seven years later, in 1989, Williams would publish South Africa’s War Against Capitalism, an examination of the economics of apartheid—a system that, according to Williams, was a repudiation of free-market capitalism, not its fulfillment. It was called “socialism with a racist face” by Thomas W. Hazlett.

In “Good Intentions,” Williams considers a handful of presumably well-intentioned government programs that actually work to the detriment of people in marginalized communities. Policies have changed and times have changed, but the arguments he advances deserve serious consideration even today, more than three decades later.

Williams considers the minimum wage and how it has affected employment among black teenagers in poor communities. As Williams notes, there is value in a so-called “dead end job” far beyond the wages one earns. It provides experience in the labor market and the opportunity to develop oneself and one’s reputation as a reliable and dependable worker. Minimum wages reduce employment opportunities, and even if they don’t they restrict the combinations of wages, benefits, and perquisites to which workers and employers can agree.

Williams also explains how licensing laws and other regulations keep people out of the market. In “Good Intentions,” Williams highlighted the problems of onerous and expensive taxi cab licensing requirements, and in her 1998 book The Future and Its Enemies, Virginia Postrel explored requirements that people have cosmetology licenses if they wish to practice African hair-braiding. Fortunately, occupational licensing reform has attracted bipartisan attention in recent years.

Finally, Williams explores the effects of specific programs ostensibly in place to help the least-well-off: public schooling and the vast array of benefit programs we call “welfare.” He argues that more competition (funded by vouchers or tuition tax credits) and parental autonomy would yield superior educational outcomes, and he points especially to the damaging effects of welfare programs that create what are called “benefit cliffs,” which occur when people suddenly lose benefits when they get a job or get a raise or what have you.

Cliffs create absolutely pathological incentives that keep people poor. Suppose someone gets a $1000 raise but then as a result of this higher income loses $500 worth of benefits from one program, and $200 worth of benefits from another program. This person faces an implicit marginal tax rate of 70%. If such a high marginal tax rate is a disincentive to work at the top of the income distribution, might it also be a disincentive to work at the bottom of the income distribution?

Williams argues that we could achieve distributional, safety-net goals with a negative income tax. With a negative income tax, someone would get transfers at relatively low incomes. Those transfers would phase out (slowly) as income increased, and at sufficiently high incomes one would make transfers. Across the income distribution under a well-designed negative income tax scheme, there is never an actual disincentive to work in the form of a massive implicit marginal tax rate.

Walter Williams is a careful and compassionate master of the economic way of thinking, and I can’t help but be convinced that the world would be a far better place today had we listened to him carefully in the 1980s. Perhaps the best birthday present we could give him would be to create a better future for our own children by listening to him carefully now.