Goodman Institute economists Lawrence Kotlikoff and Alan Auerbach were the brains behind tax reform (Tax Cuts and Jobs Act of 2017). Much of what they recommended became law, including a reduction in the top corporate income tax rate from 35% to 21%.

The economists predicted that a large inflow of capital from abroad, increased investment, higher output and higher wages would result. They also estimated that the new tax code would be just as progressive (or more so) as the one it replaced. Although the coronavirus has clearly slowed things down, more than $1 trillion in capital has been repatriated by U.S. companies.

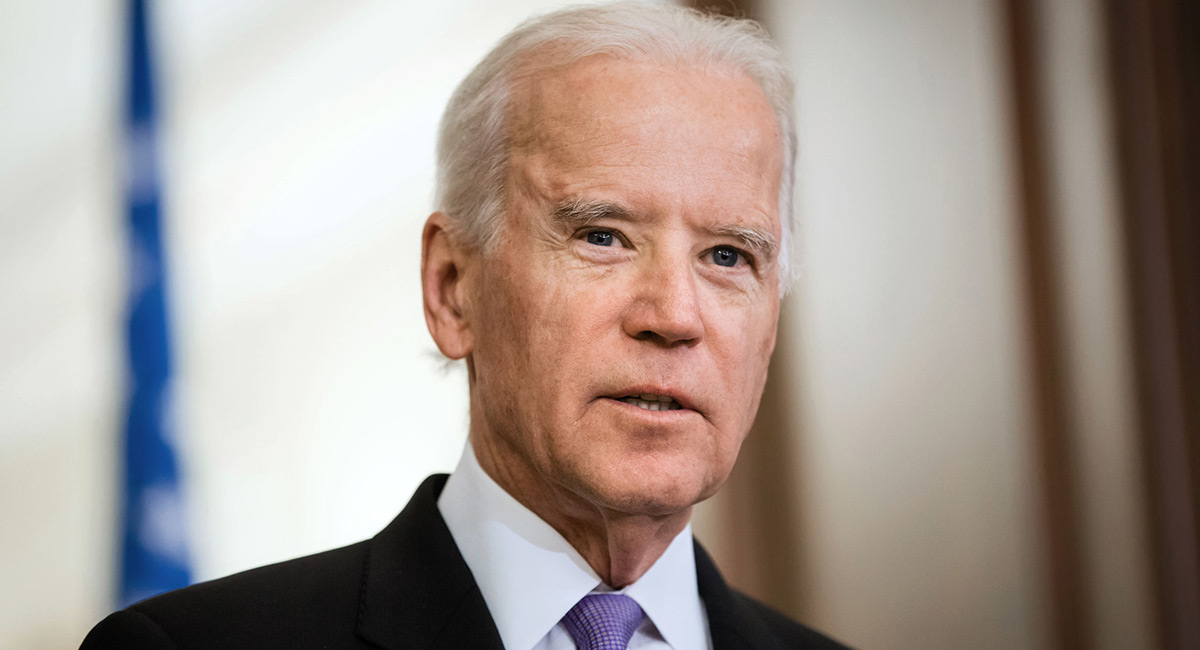

Presidential candidate Joe Biden is proposing to raise the corporate tax to 26%. His running mate, Kamala Harris, would like to push the rate all the way back to 35%—giving us the highest corporate profit tax rate in the world. Virtually every reputable economic modeling group predicts that higher corporate taxes are a burden for every income group—despite Biden’s claim that no one with an income below $400,000 would be affected.

The Congressional Budget Office and most private modelers assume that 25% of the corporate tax falls on labor and 75% falls on owners of capital. However, Kotlikoff and his colleagues, using the most sophisticated model of international capital flows ever developed, estimate that virtually all of the corporate tax is paid by labor. This implies that corporate taxes are actually quite regressive.

A tax on corporate profits, in other words, is a tax on labor, not a tax on capital.

In a study with economists at the Atlanta Federal Reserve bank, Kotlikoff and Auerbach estimate that the average household in the United States can expect a lifetime gain of $25,000 because of the 2017 tax reform act. Depending on how much of the act is repealed, moderate-income households have a lot to lose.