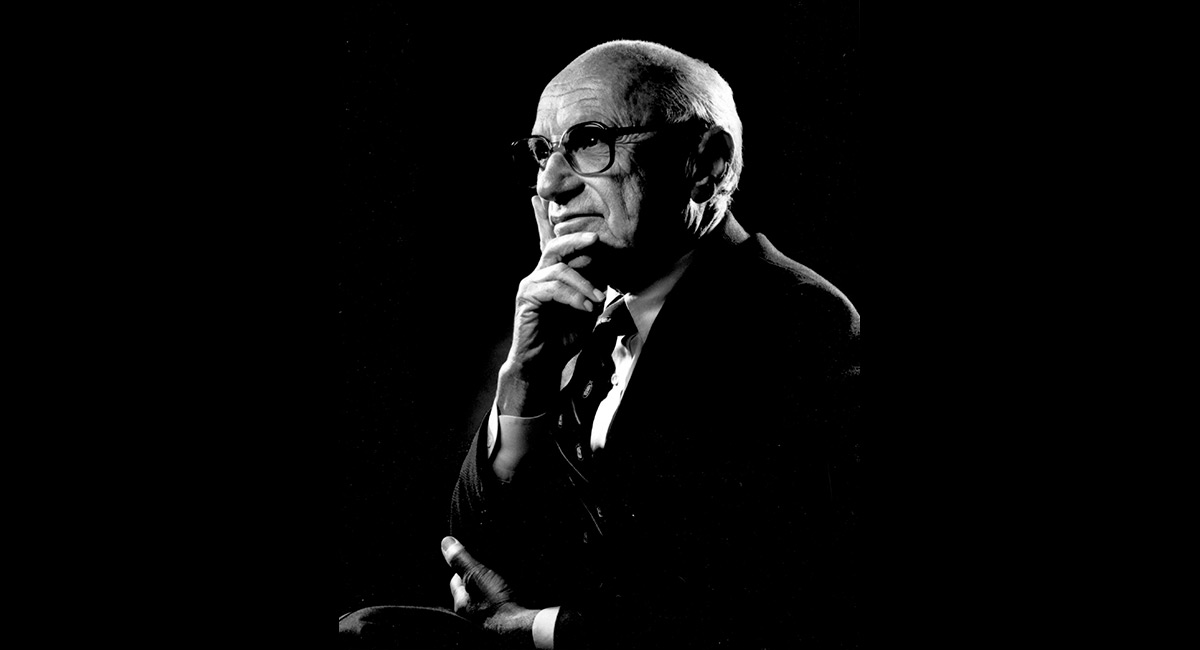

On October 14, 1976, the Royal Swedish Academy of Sciences issued a press release reporting that the 1976 Prize in Economic Sciences in Memory of Alfred Nobel was going to Milton Friedman. Friedman was no stranger to great honors. He was already one of the world’s most famous economists, and in 1951 the American Economic Association had awarded him the prestigious John Bates Clark Medal. In March and April 1976, Friedman spent about three weeks in South Africa at the invitation of the University of Cape Town’s Graduate School of Business. The University of Cape Town had been W.H. Hutt’s academic home from the beginning of his career through his retirement in 1965. I stumbled upon a bit of information about Friedman’s visit while working on a project about Hutt. Milton Friedman in South Africa compiles some of Friedman’s addresses from the visit.

It is an important collection in light of Friedman’s prominence, the overt racism of South Africa’s apartheid government and the controversy about proposals for “one man, one vote” in South Africa and Rhodesia, the controversy surrounding the “Chicago Boys” and Friedman’s March 1975 visit to Chile, and four-and-a-half decades of concerted efforts to besmirch his legacy by implicating him—and, by association, free-market economics—in human rights abuses by the brutal Chilean dictator Augusto Pinochet. It is an excellent introduction to Friedman’s worldview for those who are not familiar with him and an additional source of evidence about Friedman’s convictions for those who study him.

Much of the content will be familiar to people who are already conversant with Friedman’s work. The book contains the text of four of the addresses he gave titled “The Fragility of Freedom,” “Inflation–is it an Incurable Disease?”, “The Future of Capitalism,” and “Has Gold lost its Monetary Role?” It also reports some of his answers during question-and-answer sessions. It includes both “A Personal Note” by editor Meyer Feldberg (who helped arrange the visit) and Friedman’s article “Suicide of the West: Impressions of South Africa and Rhodesia” that had appeared in the Sunday Times on May 2, 1976.

Throughout, we see a scholar, teacher, and passionate defender of liberty who takes ideas seriously, particularly when he disagrees. Friedman’s addresses combine the urgency, gravity, and realism we expect from a defender of liberty. His essay “The Fragility of Freedom” reminds readers of the institutional darkness: “We take freedom for granted. The fact is, however, that the natural state of mankind is not freedom but tyranny and misery” (p. 3). Liberty and prosperity have been the exceptions rather than the rules.

He discusses Chile, a flashpoint in the history of classical liberalism. Friedman contends that Salvador Allende, who had been president of Chile from his election in 1970 until Pinochet deposed him in 1973, had “threatened to bring about totalitarian rule of the left” (p. 3). Allende had been the architect of a “violent inflation” brought on by deficits financed with money creation. According to the World Bank, inflation rates rose from 20% in 1971 to 77.8% in 1972 to 352.8% in 1973. It grew to 504.7% in 1974, the year after Allende was deposed, and started falling after Chilean officials took the advice of Friedman and the “Chicago Boys” and eased up on the monetary accelerator.

Friedman was allegedly an “advisor” to Pinochet. In reality, they met for 45 minutes, and Friedman sent him a letter outlining some of the points he had raised during their talk. He was under no illusions about what the Pinochet regime meant, writing, “Chile is no longer a relatively free country. It is now a country which is ruled by the armed forces and in which individual freedom is far more restricted than it was before.” Of course, Friedman did not receive nearly as much criticism for his 1980 trip to Communist China, but I digress.

The next address in the volume looks at inflation in greater detail. As I tell my students, we are fortunate to have lived pretty much our entire lives during a period in which inflation hasn’t been much of a concern. Inflation is a political problem because it is almost irresistible to government officials. The good effects of inflation are immediate; however, the harmful effects take some time to materialize. Meanwhile, cutting money growth to stop or slow inflation front-loads the harmful effects and back-loads the good effects. Keeping inflation under control is, therefore, mostly a matter of keeping the potential inflators under control. Of course, Friedman had been a monetary heretic when he had suggested, as he wrote in 1976, that “The direct cause of inflation is too much money relative to output” (p. 12). Friedman would be vindicated, first by the widespread acceptance of the historical research he did with Anna Schwartz in A Monetary History of the United States (1963) and then by the events of the 1970s and 1980s.

Throughout his career, Friedman pointed out how policies that might be “good for business” were not necessarily “free market” policies. To one audience, he quipped that “The businessman is always in favour of freedom for everybody else but he always wants special treatment for himself” (pp. 28-29). He defined “free enterprise” as “freedom to compete,” and few businesses welcome competition. It reminds me of (Steven) Horwitz’s First Law of Political Economy: “No one hates capitalism more than capitalists.” Few people understood that like Friedman.

The last address appearing in the volume asks, “Has Gold lost its Monetary Role?” It is a useful and nuanced discussion of monetary history that reveals Friedman the pragmatist (and the Friedman who periodically draws the ire of gold standard enthusiasts). There has not been a particularly easy-to-identify “gold standard,” particularly in the run-up to the Great Depression. The gold standard before 1914, he argues, was very different from what he called the “pseudo-gold standard” that emerged after World War I. This address makes it clear that he is not optimistic about any government’s ability to get back on an actual “gold standard” in which people use gold and gold substitutes as money.

This address is also a good jumping-off point into what Friedman said about apartheid and racial institutions during his visit. On March 30, 1976, he met with Chief Mangosuthu Gatsha Buthelezi, a South African leader committed to a peaceful end to apartheid (more on this meeting is available here and in his memoir, Two Lucky People, coauthored with his wife Rose Director Friedman). When he was asked about “blacks, whites, and egalitarianism,” Friedman replied, “I believe South Africa will find it difficult to remain a stable society if it continues to a have a discrepancy of ten-to-one between one sector of the society and another” (pp. 48-49). It calls to mind similar warnings about inequality in the United States today. In true libertarian fashion, however, Friedman strongly advises against funded transfer programs aimed at establishing equality, calling it “the approach of the controlled society, not of the free society” (p. 48). He recommends instead that “The first thing you ought to do is to eliminate the barriers which you now impose on equal movements, on equal opportunity, for the various groups” (p. 48).

His argument here is consonant with the statements W.H. Hutt made about the need to end the regime of special privilege for whites. Like Hutt, Friedman argued that “One of the beauties of the market mechanism is that it is color blind” (p. 49). Also like Hutt, he thought the end of special privileges for white workers would be the surest path toward economic equality. He nonetheless recognized the tough political reality, saying, “If I was a white man in South Africa I would find it extremely difficult to let go of my privileged position” (p. 56).

He remained a hard-headed realist rather when it came to political reform in South Africa and Rhodesia. He did not approve of apartheid or segregation, writing of segregated Rhodesia that at least “there is no evidence of that petty apartheid–separate post office entrances, toilets, and the like–that was America’s shame in the South and that I find so galling in South Africa” (p. 59). He was nonetheless skeptical of reform proposals, writing, “‘Majority rule’ for Rhodesia today is a euphemism for a Black-minority government, which would almost surely mean both the eviction or exodus of most of the Whites and also a drastically lower level of living and of opportunity for the masses of Black Rhodesians.” He based this on what he called “the typical experience in Africa–most recently in Mozambique” (p. 60). In other words, it wasn’t clear to Friedman that replacing tyrannical rule by a white elite with tyrannical rule by a black elite would be an improvement. In 1980, Robert Mugabe would ascend to the Presidency. In 2003, The Atlantic would publish a story titled “How To Kill a Country: Turning a breadbasket into a basket case in ten easy steps–the Robert Mugabe way.” When asked to opine on democracy and “the will of the public” at one of the speeches he gave in Johannesburg, Friedman said

“The basic problem with the political mechanism is that it requires too high a degree of conformism, which is very difficult to achieve without a very homogeneous population. Fundamentally, groups of people who differ very widely in custom and background can only live peacefully together in a laissez-faire world” (p. 50).

Friedman was an exemplar of what Thomas Sowell called “the constrained vision.” He based his inquiry, analysis, and recommendations on how people are rather than how many reformers imagine them in a perfect world. It’s a position that leads us to many unhappy and frustrating conclusions. At the very least, it’s a position that doesn’t take a bad situation and make it worse. Milton Friedman in South Africa is a fascinating product of one of Friedman’s ventures during a controversial time. It is worth reading for anyone interested in understanding Friedman specifically or what Andrei Shleifer called “The Age of Milton Friedman” more generally.