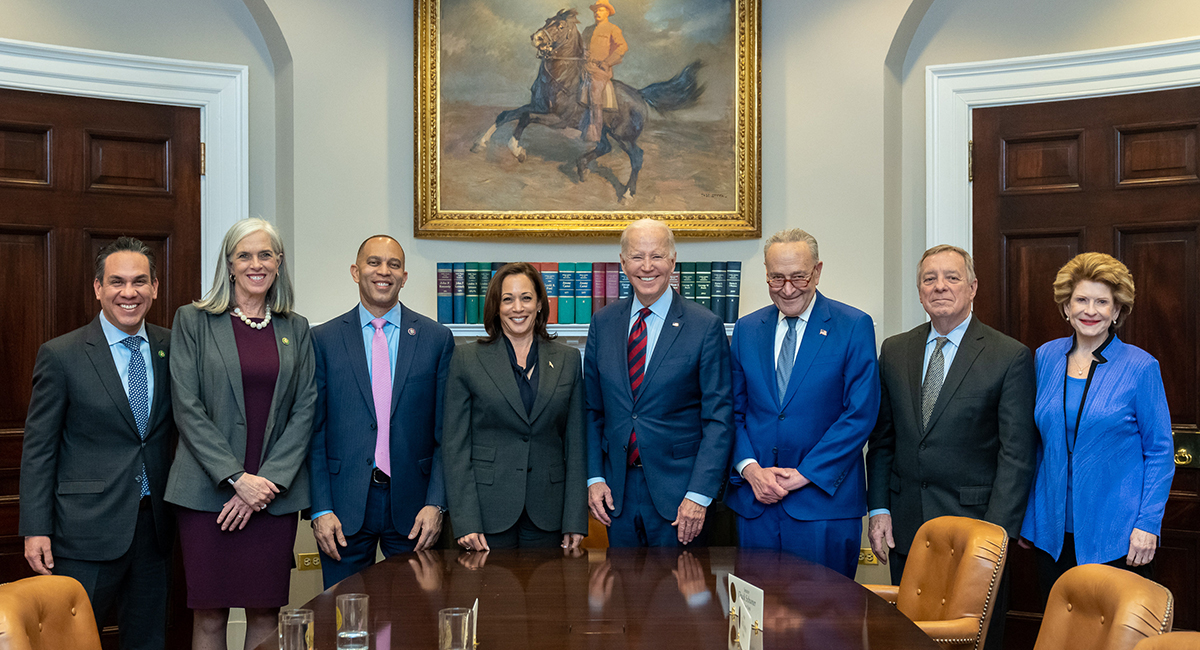

The Biden Administration’s 2023 budget bill made headlines by proposing a so-called “billionaire tax,” imposing a 25-percent minimum rate on the “unrealized capital gains” of the wealthiest Americans. The Biden measure rests on an economic falsehood. The new proposal rests on the work of far-left academics such as Thomas Piketty and Gabriel Zucman, who erroneously claim that wealthy Americans pay a lower tax rate, on average, than the poor. This assertion arises from a compounding of basic empirical errors, beginning with the blurring of the distinction between income (annual earnings) and wealth (net worth) as well as a fair amount of intentional statistical manipulation.

In addition to being premised on bad economic reasoning and contrived evidence, Biden’s proposed wealth tax will also likely face another obstacle: it is blatantly unconstitutional.

To see how, we must turn to the text of the Constitution itself. Article I, Section 8 of the document establishes the “Power to lay and collect Taxes, Duties, Imposts and Excises, to pay the Debts and provide for the common Defence and general Welfare of the United States” with the stipulation that these measures must be uniform. A separate clause in Article 1, Section 9 stipulates that “No Capitation, or other direct, Tax shall be laid, unless in Proportion to the Census or Enumeration herein before directed to be taken.”

When read together, these two clauses divide the taxing power of the federal government into two categories: direct and indirect taxation.

If a tax is indirect, it may meet constitutional muster by simple uniform application across the entire country. Consider a national excise tax on alcohol sales, one of the earliest and longest-standing federal tax measures in existence. Under the current federal excise tax, distilled spirits are taxed at $13.50 per proof gallon, regardless of the state in which they are purchased and consumed. A parallel tax similarly covers liquor that is imported from abroad, again, meeting the uniformity requirement by applying to all states.

A direct tax, by contrast, must meet the apportionment requirement of the Capitations clause, with one notable exception arising from a later amendment. As originally designed, this meant direct taxes had to be divided in proportion to the population of each state, and then assessed within the population of that state. Since state population is the determinant, this formula could conceivably lead to 50 different tax rates, under the Constitution’s design. The resulting system would likely face insurmountable political opposition, in addition to being impractical to implement and enforce.

So, how did the Constitution originally differentiate direct and indirect forms of taxation? That subject came up in one of the first major Supreme Court cases, Hylton v. United States in 1796. Borrowing his reasoning directly from Adam Smith’s Wealth of Nations, Justice Paterson wrote that “All taxes on expenses or consumption are indirect taxes.” The Court, accordingly, affirmed the constitutionality of a federal sales tax on carriages, finding that it was not subject to the apportionment formula of the census.

This outcome precluded the need to elaborate on direct taxation, however, the legal arguments from the case also settled that question. Alexander Hamilton’s brief for the case defines direct taxation to include “capitation or poll taxes,” “taxes on land and buildings,” and “general assessments, whether on the whole property of individuals, or on their whole real or personal estate.” All other taxes, Hamilton continues, “must of necessity be considered as indirect taxes.”

Although the Court determined that the carriage tax fell outside of the direct-tax classification, another federal tax almost a century later would run afoul of the apportionment rule. In 1894, Congress established a federal tax of two percent on incomes over $4,000. The measure sparked a complex array of legal challenges, on the basis that Congress had laid a direct income tax without meeting the apportionment requirement from the census. The following year, the Supreme Court struck down a key provision of the new income tax measure. Taxes on income derived from interest, dividends, and rent, the Court ruled in Pollock v. Farmer’s Loan & Trust, qualified as direct taxation. Since this tax did not meet the apportionment requirement, the Court struck it down.

The fallout from the Pollock ruling dominated national politics for the next decade, as opponents of the existing tariff-based revenue system lobbied to replace it with an income tax. The impasse finally broke in 1909, when Congress adopted the 16th Amendment (ratified in 1913).

This Amendment authorized the modern federal income tax, but not by repealing the older apportionment rule of Article 1, Section 9 as is commonly assumed. Rather, the 16th Amendment carved out a very specific exception to the existing clause. As its text states, “Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.”

Congress may accordingly levy a direct tax on income earnings without needing to meet the census-based apportionment stipulation. It has done so from 1913 to the present day, under the all-too-familiar form that we fill out every April. Note, however, that the Amendment’s text does not exempt other forms of direct taxation from the apportionment requirement.

A tax on “unrealized capital gains” cannot be a tax on income, as no income is generated in the process, only an estimated increase in valuation. It is “unrealized” by definition. Indeed, post-16th Amendment jurisprudence has generally held that money must be “realized” and received in order to qualify as income, most notably the 1920 case of Eisner v. Macomber.

If Biden gets his tax, it would face a steep and immediate constitutional challenge. The administration is likely banking on a series of extremely tendentious arguments by far-left law professors to argue that previous jurisprudence on this question should be discarded. These arguments often begin from the assumption that Pollock was wrongly decided, and openly advocate judicial activism from the bench, as a strategy to bypass the apportionment requirement through semantic games. Even supporters of the idea concede that this strategy is unlikely to pass muster with the current Supreme Court.

It’s a fitting realization. Much like the contrived economic arguments behind the wealth tax, its legal arguments are a result of politically motivated reasoning to bring about a new tax system that the Constitution prohibits.