The price of prescription drugs has been a major talking point in this year’s elections. Having the government negotiate drug prices was a major change in federal policy—occasioned by the Inflation Reduction Act (IRA). Many want to go further, giving Medicare the power to enter more negotiations over more drugs.

Surprisingly, with policy makers focusing on the role of drug manufacturers, almost no attention has been paid to the way in which traditional Medicare (as opposed to Medicare Advantage plans) causes the elderly and people with disabilities to overpay for the drugs they use. This occurs for three reasons: traditional Medicare requires three separate insurance plans for comprehensive coverage, traditional Medicare drug plans are required to community rate, without adequate risk adjustment, and pharmacy benefit managers (PBMs) are able to calculate patients’ coinsurance based on list prices, rather than on the actual discounted prices the PBM pays the manufacturers.

A fourth factor will cause beneficiaries in all Medicare plans to pay more for drugs and drug insurance in the coming years. This will occur because of the little discussed fact that the IRA removes more than $300 billion of government funding from Medicare Part D over 10 years—leaving the market with no alternative but to shift costs to beneficiaries.

Three Premiums For Three Plans

Seniors in traditional Medicare usually pay separate premiums to three different insurers: one for Part B (for doctor care), which is administered by the government; a second for private Part D drug coverage; and a third for private Medigap insurance—to plug the holes in Parts A, B, and D.

Yet, because the suppliers of these three insurers have differing financial interests, the results are waste, inefficiency, and inferior patient care. For example, if a diabetic skips their insulin and other medications, that is profitable for the drug insurer—since these are expenses it doesn’t have to cover. However, if non-adherence to a drug regimen leads to emergency department visits and hospitalization, those are costs the other two insurers will have to bear.

The fact that the insurers have competing and opposing financial interests means that there is no possibility of alignment in traditional unmanaged Medicare with the goal of cost-effective, well-managed care.

Medicare Advantage (MA), which now provides Part D drug coverage to 57 percent of all beneficiaries, avoids this problem because there is typically only one premium paid to one plan. Since that plan is responsible for all the costs of care, the plan has an incentive to keep enrollees healthy at minimum cost. In general, the economic return to drug therapy is much higher than the return to doctor or hospital therapies. So, these plans have an incentive to encourage enrollees to take full advantage of drugs needed to treat chronic illnesses.

Perverse Incentives To Sacrifice The Sick For The Benefit Of The Healthy

When insurers are forced to community rate and there is no adequate risk adjustment—as is the case in freestanding Part D plans—they have an incentive to make their plans less attractive to the sick and more attractive to the healthy.

While this is a huge problem in the traditional Medicare program, it is avoided in Medicare Advantage (MA) because MA plans receive risk-adjusted premiums, based on the health conditions of the enrollees. This means that the healthy and the sick tend to be equally attractive to MA plans from a financial point of view.

Things are different for a traditional Medicare Part D plan. These plans make money when the healthy enroll, and they lose money on sick enrollees. Since healthy people tend to buy on price alone, these plans compete to get their premiums as low as possible. Since enrollees with high health care costs tend to look at the out-of-pocket exposure, the plans can discourage enrollment by the sick with high deductibles and high coinsurance payments.

Once enrollment has occurred, traditional Medicare Part D plans use the money they save by imposing high deductibles and coinsurance on costly drug consumers to subsidize lower premiums for enrollees who are relatively healthy. If the high drug consumers leave the plan, so much the better. The plan did not want them in the first place.

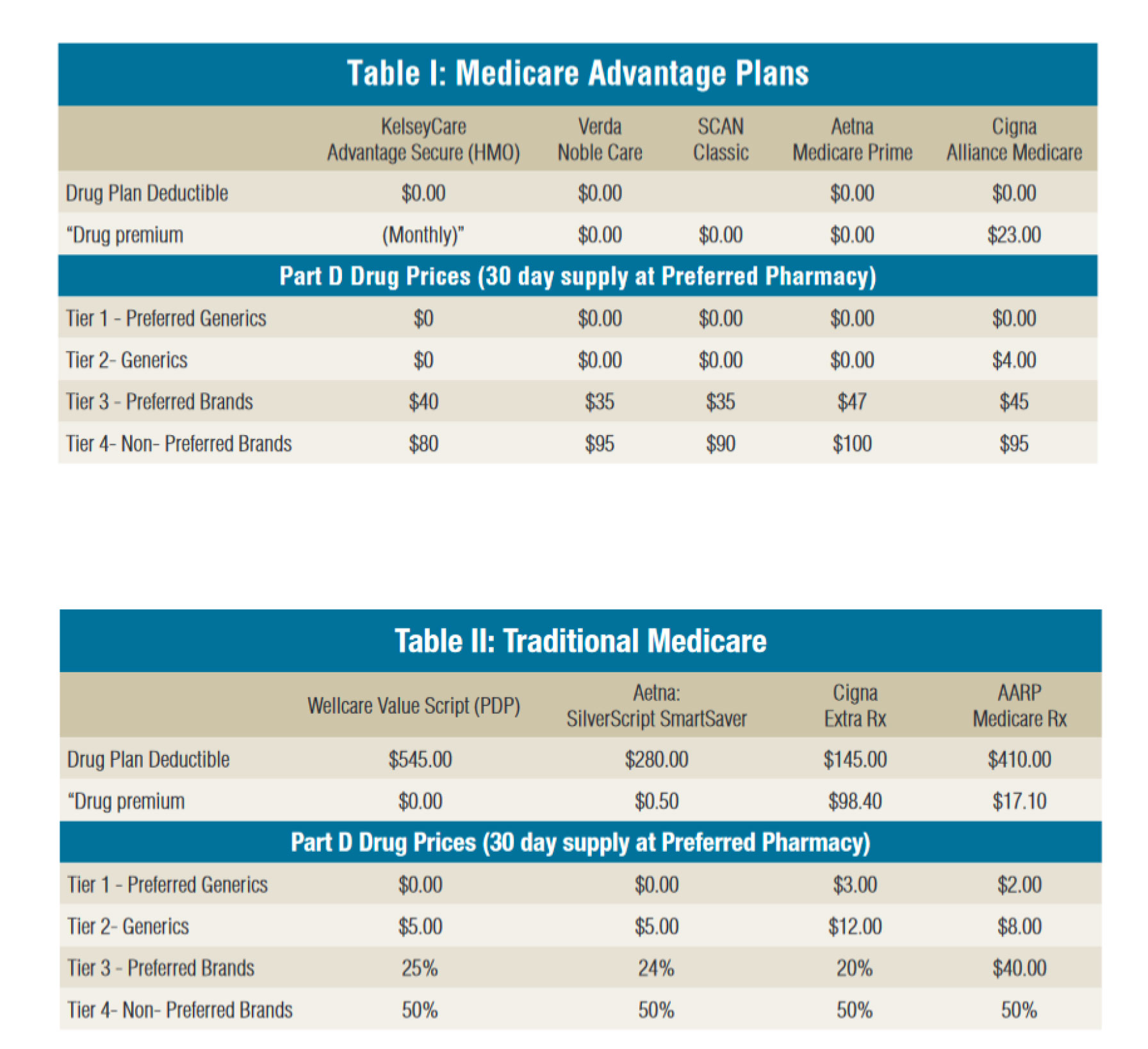

Exhibit 1 shows the effects of these incentives for a sample of plans in the Houston, Texas, area, where there is a lot of MA activity. The deductible is zero in the MA plans but is more than $500 in some of the traditional Medicare plans. Furthermore, the copayment and coinsurance rates are uniformly lower in the MA plans than in the traditional Medicare plans.

Not every MA Part D plan has a zero deductible, but based on our review of plans in the Houston areas, MA drug deductibles are almost always lower than traditional Medicare drug deductibles, and the same is true of cost sharing at the point of purchase.

Exhibit 1: Comparison of premiums, deductibles, and cost sharing under selected Medicare Advantage Part D plans versus traditional Medicare Part D plans, Houston area, Texas, 2024

Basing Patient Coinsurance On List Prices Instead Of Net Prices

Say a diabetic goes to a pharmacy where the list price of insulin is $100. Her 25 percent copayment amounts to $25. However, unbeknownst to her, the insurer is getting, say, a $90 rebate from the drug company that produces the insulin. That means that the real cost of the insulin to the insurer was only $10. So, a fair out-of-pocket charge to the patient would be only $2.50, not $25.

What happens to the savings that the insurer retains (or which a PBM captures on its behalf) by negotiating a rebate that is not shared with the patient? It is used to lower Part D premiums, thus causing the sick, who need drugs, to be overcharged at the pharmacy counter, while the relatively healthy are (arguably) undercharged when they pay insurance premiums.

In general, this problem seems to be avoided in the MA market. Based on our review of Houston-area Part D plans, the much lower coinsurance under MA suggests that the plans usually require PBMs to pass along rebates to the patients. The only reason MA plans charge deductibles and coinsurance at all is to discourage waste. That is, they do not want patients to acquire costly drugs they don’t intend to use. But they have no incentive to make the cost sharing so high that patients do not acquire their drugs at all because that would risk costly medical problems.

In the Houston area, Aetna, Cigna, Elevance (Anthem), SCAN, and VERDA Healthcare offer MA Part D plans that make maintenance drugs for the chronically ill completely free or available at a very nominal fee. SCAN Health Plan, a company operating special needs MA plans for diabetics, makes insulin available for free and provides free visits to an endocrinologist. In SCAN Health’s special needs plan for heart patients, there is no charge for cardiac maintenance drugs or visits to the cardiologist. VERDA Healthcare is another company that provides free insulin and other maintenance drugs to enrollees who have diabetes, heart health issues, and cardiovascular disease.

Both President Donald Trump and President Joe Biden have, at various times, claimed credit for capping the cost of insulin. What neither seemed to know is that MA Part D plans around the country have been charging $35 or less for insulin for years.

The IRA Raid On Part D Funding

Much has been said about the pros and cons of Medicare’s negotiation of drug prices under the IRA and about the wisdom of constraining price increases for new drugs to the rate of inflation. (For example, see the analysis by University of Chicago economists.) We have nothing to add to those debates.

Instead, we draw attention to a provision of the IRA whose near-term impact on patients swamps all other provisions of the bill combined by several orders of magnitude. This is the removal of more than $300 billion in government subsidies for Part D insurance over the next 10 years. It mainly consists of a retreat from subsidizing catastrophic drug expenses. The federal government, which once paid 80 percent of the cost of Part D catastrophic prescription drug spending (above $8,000 in 2024) is now, due to the IRA, paying 60 percent under Part D. That drops to 20 percent next year, and the bulk of that reduction is shifted to private insurance plans, with a smaller portion being shifted to drug manufacturers. Those costs will, inevitably, be borne by beneficiaries through higher drug prices and insurance higher premiums.

Other provisions of the IRA are already having an effect on premiums. From 2021 to 2024, the national average Part D premium under traditional Medicare has increased by 46 percent, from $41.60 per month to $60.92 per month. In nine states, the average premium has increased by more than 60 percent—including by 75 percent in Georgia and 84 percent in California. The reduction in federal funding this year will push those premiums even higher.

Administration officials have been in a panic over the possibility that premiums could double or even triple for this October’s open enrollment—right before the election. To avert that, we are now told the administration is preparing to give $7.2 billion to insurers in a premium stabilization “demonstration project,” that we believe is more accurately called a “bribe” to induce the insurers to keep their premiums down.

The demonstration faces a court challenge or two. But even if it gets the administration past this fall’s election, demonstrations do not go on forever. There is no way to avoid substantial premium hikes in the future without congressional legislation undoing much of what the IRA has done regarding catastrophic drug spending.

The $300 billion raid is almost never talked about by politicians who voted for the IRA. President Biden even said, “I will never cut Medicare,” after he had already signed the IRA. However, there has been a great deal of election-eve talk about next year’s $2,000 cap on out-of-pocket expenses for prescription drugs. Since the government is taking money away from Medicare on the net, this is not a freebie. Seniors will have to pay for the new benefit. We suspect most would be willing to do so if they knew the cost—estimated at a premium increase of $4.35 a month.

Many may think that is a price worth paying. Given how modest it is, we wonder why the cap was not imposed 20 years ago when Part D was created. Although this is perhaps the most talked about provision of the IRA, it is a small part of the overall impact. Without the “demonstration project,” next year’s premium increases could be 10 times that amount.

There is another way that the IRA penalizes seniors. As noted, drug plans are paying wholesale, while their enrollees’ coinsurance is based on retail. In 2020, the Trump administration sought to end this practice with a regulation requiring that manufacturers’ Part D rebate payments be applied to drug prices at the cash register—thus passing discounts directly to patients. According to Milliman, patients were expected to save almost $15 billion over the next 10 years. The IRA, however, delayed Trump’s regulation until 2032. Interestingly, the Congressional Budget Office (CBO) estimates that overcharging patients saves money for the government because patients purchase fewer drugs at the higher prices! In fact, the CBO says that keeping prices so high that patients can’t afford them (that is, delaying the Trump regulation) will save the government $26 billion in the year 2031.

All told, one study finds that less than six million people (less than 10 percent of Medicare beneficiaries) will see lower drug spending as a result of the IRA. Moreover, 69 percent of those with any savings at all will save less than $300. Meanwhile, the vast majority of beneficiaries can expect higher premiums and higher drug costs.

Conclusion

Studies of various aspects of the health care system consistently show that people respond to incentives by acting in their own economic self-interest. Furthermore, for-profit entrepreneurial firms tend to respond to changing incentives very quickly.

This is a good finding. It means that if we get the incentives right, entrepreneurs will rather quickly solve problems that otherwise might linger for decades.

The political problem is in getting the incentives right. All too often, that task appears unachievable.