The trade war against China has been escalating since it began in 2018. One of China’s lethal weapons is rare earths, which the Chinese national state media Xinhua calls “industrial vitamins.” They play a strategic role in today’s high-tech world. Indeed, this group of 17 chemically similar metals is integral to modern

When it comes to national defense, rare earths play a critical role. For example, an F-35 fighter jet requires more than 900 pounds of rare earths, an Arleigh Burke DDG-51 destroyer requires 5,200 pounds, and a Virginia-class submarine consumes over 9,200 pounds. And rare earths are pricey. For example, scandium, which is often used in military applications, is priced at over $270 for a single gram. For rare earths in general, not only are prices sky-high, demand is surging, too.

China dominates the production and processing of critical materials: It produces over 60 percent and processes nearly 90 percent of the world’s supply of rare earths. If that’s not enough, China dominates in the sphere of intellectual property. Since 1950, China has filed more than 25,000 rare-earth patents, versus 10,000 filed by the United States.

Just how did China gain such dominance across the board in critical materials? Targeted investment in both industrial projects and education, as well as state-backed subsidies, have given rise to China’s global dominance in what one of us dubbed the 3Ms: mining and mineral engineering, metallurgical engineering, and materials science and engineering.

In 1975, China established the National Rare Earth Development and Application Leading Group. In 1991, four rare-earth elements were designated as protected minerals, thereby restricting foreign investments. Then, in 1992, rare earths were given a strategic boost by Chinese leader Deng Xiaoping when he stated, “The Middle East has oil; China has rare earth” and added that China will make full use of its advantages. In 2001, China’s tenth Five-Year Plan formally prioritized the development of critical materials. Most recently, on October 1, 2024, the State Council of the People’s Republic of China fired yet another warning shot across the bow of the critical materials space. It implemented its new “Rare Earth Management Regulations,” a sweeping framework for consolidating the state’s control on rare earths.

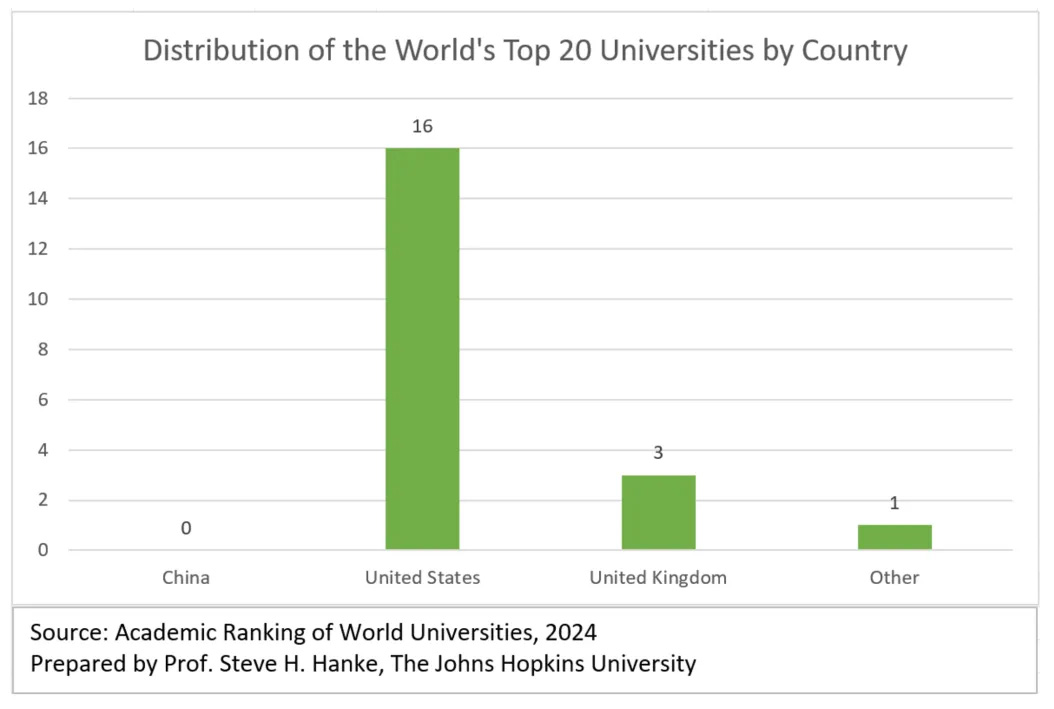

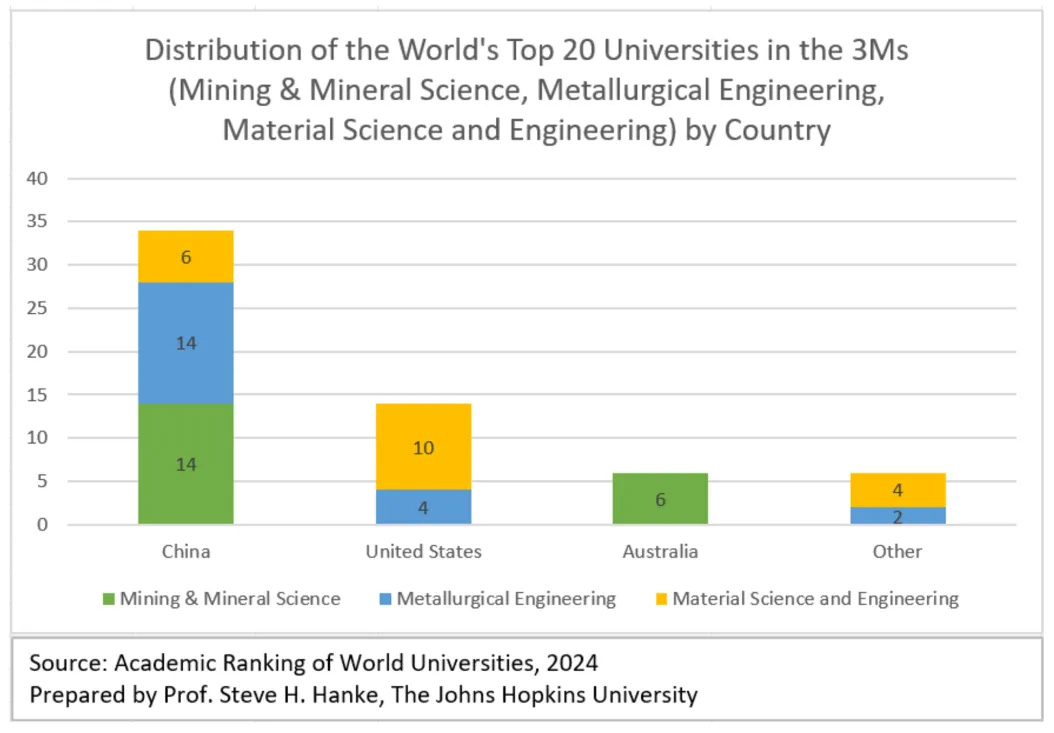

China’s dedication to advancing the 3Ms is evident. When it comes to the world’s top-flight universities, Chinese universities are conspicuously absent from the ranks of the world’s top 20. Yet, the landscape is altered dramatically when we turn to the 3Ms. In these fields, Chinese universities dominate, accounting for 70 percent of the top 20 universities in both mining and mineral science and metallurgical engineering, and 30 percent in material science and engineering. U.S. institutions trail far behind: While they dominate with 80 percent of the global top 20 universities, they are nowhere to be found in the field of mining and mineral science.

China’s dominance extends beyond the rare earths to a broader array of critical materials. Its squeeze on them has continued to tighten. For example, in August, China levied restrictions on exports of antinomy, a critical material used in a wide range of important products and a critical alloy in the production of munitions. In December, China’s restrictions on the export of antimony, along with some other critical minerals, were switched to an outright ban on its export to the United States. The effect of the August restrictions and December ban has been significant: Since August 12, two days before the antimony restrictions, the price of antimony has shot up by over 69 percent.

What lies ahead? President-elect Donald Trump, with his repeated threats and decisive moves, is playing chess. By contrast, President Xi Jinping is playing the native Chinese game of Go—which emphasizes subtlety and small, relative advantages that accumulate over time.

China’s Go-inspired strategy, with its patient and deliberate accumulation of influence, has gradually encircled the West in the critical-materials sector. Building on its decades of strategic preparation, China has begun to wield its advantages over critical materials as a counterbalance against the West.

Critical materials are clearly an ace up Beijing’s sleeve.