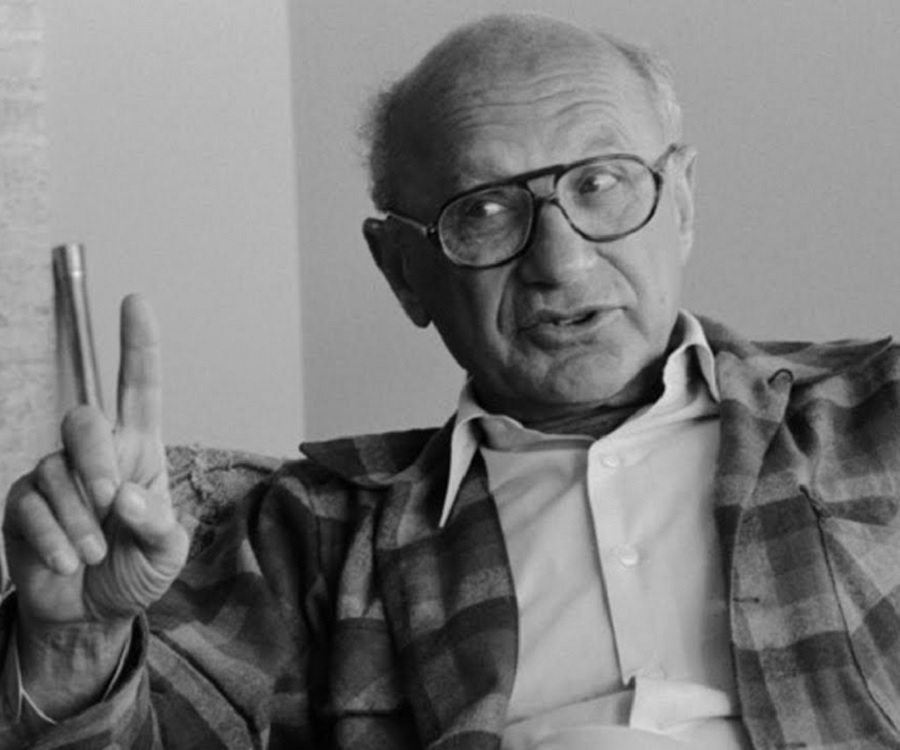

On July 31 Milton Friedman would have turned 96. Why should you care? Because the revolutionary Nobel prize winning economist did more than any other person of his generation to advance his belief in freedom, free markets, and prosperity. Friedman was once asked why a wealthy economist would focus so much effort on poor kids from the inner city. He bowed his head and knit his fingers together. “What are we here for?“ he asked. “We’re here to try to make the world a little better than we found it.”

One way Friedman tried to make the world better was by promoting a negative income tax (NIT) that would both help the poor and reduce destructive politics. The NIT would replace all income programs with a simple cash payment to every citizen. If, for example, the payment were $6,000, a family of four with no income would receive an annual payment from the IRS of $24,000. For each dollar earned by members of that family, the payment would be reduced by some fraction—Friedman suggested possibly 50 percent. Thus, if the family of four receiving $24,000 earned $12,000 in a year, their net payment from the IRS would be $18,000 (the original $24,000 minus $6,000 tax on their earnings). But they would still have the $12,000 so their total income would increase to $30,000.

Friedman’s NIT is far better than more standard welfare programs for several reasons.

First, working always pays more than not working. By contrast, many welfare programs do just the opposite—if you earn an extra dollar you lose two dollars of benefits.

Second, instead of life for welfare recipients being “one endless visit to the Welfare Office,” as author P. J. O’Rourke puts it, welfare recipients are freed to make their lives better. The NIT’s cash payments replace the army of bureaucrats doling out food stamps, temporary assistance to needy families, Medicaid, Medicare, housing assistance, school breakfast and lunch, food stamps, rent subsidies, and the myriads of others.

Third, welfare money actually makes it to the intended recipient. In the United States less than one quarter of every dollar spent on welfare makes it into the hands of the needy. The rest is consumed by people between the Congress and the intended recipient. Aid to Africans is even worse with fewer than 15 cents of every dollar finding its way to the poor.

These three improvements from the NIT are widely recognized, but there is a fourth improvement that is hidden but highly important—lobbyists for the many industries benefiting from welfare policies have to go to work doing something productive. Farm lobbyists argue for farm subsidies because they are necessary to provide the food for school breakfast and lunch programs. They lobby against direct aid to the needy because poor people might not spend the money on food. Thus, food stamp programs allow the stamps to be spent only on a limited list of foods and certainly not on television sets or cell phones.

And urban lawmakers buy into the claims. The urban members of Congress support farm subsidies because the farm-state members vote for nutrition programs. To make the link really clear to the urban members of Congress, food stamps were added to the farm bill in the 1960s. “There’s no secret why foods stamps are in the ag bill-because they get votes from people who wouldn’t know a corn stalk if they saw one,” explained Rep. Ray LaHood, R-Ill., a former Agriculture Committee member. Urban lawmakers get to bring home the nutrition program bacon while Midwest congressmen get corn and soybean subsidies; the Great Plains get wheat subsidies; Southwest, Texas and California congressmen get help for cotton, rice and peanuts; the Northeast, upper Midwest and Southeast get dairy supports; and sugar subsidies go to cane producers in Florida, Louisiana, Hawaii and beet growers in many Northern states.

Friedman’s negative income tax is based on more than his belief that if the main problem of the poor is that they have too little money, the simplest and cheapest solution is to give them some more. Doing things efficiently is certainly a good thing but letting people make judgments for themselves is even more important. Government, according to Friedman, should not be a dispenser of favors; it should keep its nose out of people’s private lives and out of people’s economic business. The paternalism of rent subsidies, food stamps, etc., violates that view of government.