On the campaign trail in 2016 and again in his 2017 inaugural address, President Trump made pointed reference to “the forgotten man” and promised that he would be forgotten no longer. His message certainly resonated with his intended audience: struggling blue-collar workers in decaying industrial regions, young people woefully equipped for today’s high-tech jobs, and good country folk who missed out on opportunities to earn a good living in today’s global economy helped secure an astonishing upset presidential victory for the wealthy businessman.

We believe, however, that America’s truly forgotten men and women are found elsewhere. They are the unborn taxpayers who will ultimately and inevitably bear the burden of paying for Mr. Trump’s deficit-financed campaign promises and post-election pivots.

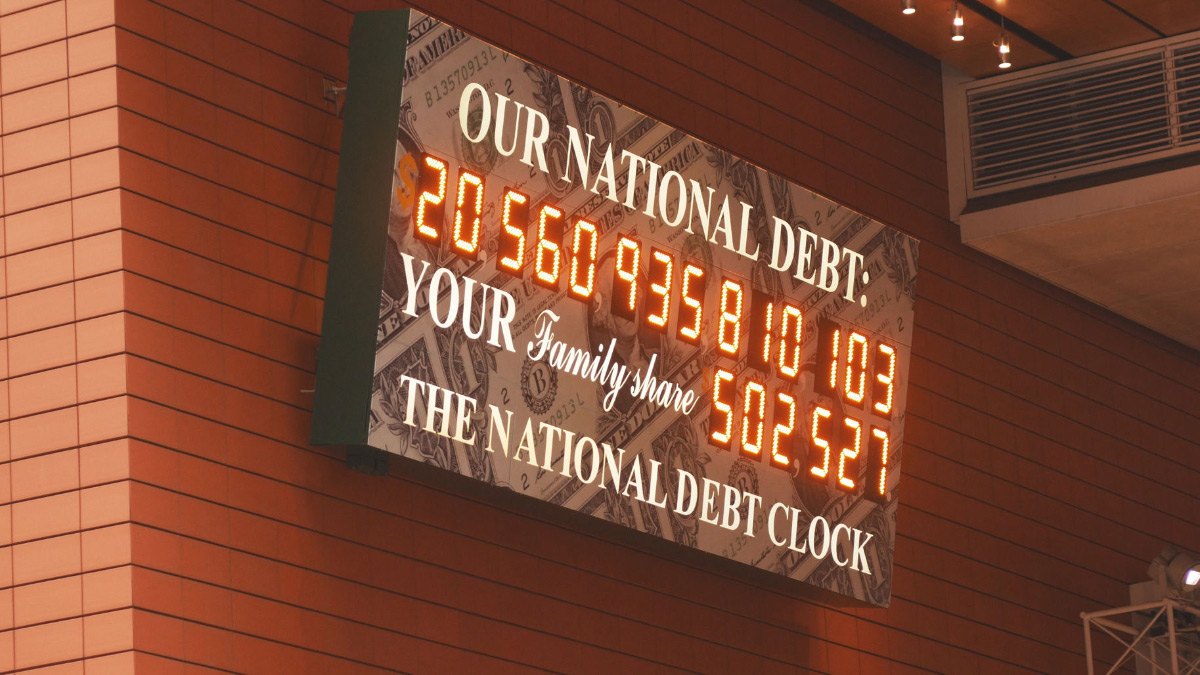

To be sure, the federal debt has been on an overall upswing for decades. The last time debt held by the public amounted to less than a quarter of GDP was when Jimmy Carter occupied the Oval Office in 1979. But President Trump has surely done his part to add to the debt problem by cutting taxes without commensurate spending cuts.

The Congressional Budget Office estimates that the Tax Cuts and Jobs Act, which the president signed last December, will add almost $1.8 trillion to the federal debt over the next decade. By 2027, debt held by the public will reach 97.5 percent of GDP, 6.3 percentage points higher than the CBO’s estimate before the 2017 tax reform. On a per capita basis, this amounts to an increase of over $5,000 in the public debt for every man, woman, and child in the country. The $1.3-trillion omnibus spending bill the president signed last month only adds fuel to the fiscal inferno.

Along the way, interest to be paid on the debt will become a fiscal force to be reckoned with. In 2017, interest payments soaked up 8 percent of federal revenues, which was easy enough to pay. As interest rates rise, Moody’s Investor Services estimates that interest payments will consume more than 21 percent of revenue by 2027.

By jacking up deficits and debt, just as previous presidents have done, the Trump administration has increased the burden borne by future taxpayers, who will, one way or another, pay for this generation’s government-provided benefits. Certainly, at least some of President Trump’s “forgotten men” have been made a bit better off—but an invisible group, the unborn future taxpayers, have been made worse off. These truly forgotten Americans have zero political representation.

It makes perfect political sense for elected officials to forget them. Unborn future taxpayers neither vote nor complain; they neither lobby nor hold rallies. They will simply be called upon to pay a bill for goods they did not consume. What could be more appealing to the president, or to any politician?

But won’t today’s deficit-financed government programs help enrich future taxpayers, enabling them to pay off the debt that we passed along to them? This is clearly possible in some circumstances. Investments in schools, transportation infrastructure, and cyber-security, for example, may yield high future returns. However, government spending that supports current consumption for the living does little to enrich citizens of the future.

Moreover, the current mix between federal spending on investment and consumption is greatly tilted toward the latter. Expenditures on Social Security, Medicare, Medicaid, and other means-tested entitlement programs that support consumption are high and destined to grow in the years ahead, feeding deficits and increasing as a share of the budget.

Ever since the Carter years, these entitlement expenditures plus interest on the debt have consumed over half of the federal budget. In 2017, they stood at 70 percent. Five years from now, the Office of Management and Budget projects they will account for three of every four dollars of federal spending.

When such a large share is spent on entitlements and interest, little is left over for investments that could enhance future GDP growth. Many Americans would be shocked to learn that federal expenditures on public capital, research and development, and education and job training have amounted to less than 10 percent of total outlays for decades, and the OMB projects an all-time low of just over seven percent in 2018.

But their greatest source of moral revulsion should come from a disheartening revelation: future citizens will be made worse off to pay for wildly popular entitlement programs that benefit current citizens—those who vote and can raise their voices in protest if asked to pay.

Many, perhaps most Americans have felt neglected by a distant government in far off Washington, D.C., where partisan bickering seems to overwhelm what citizens want most from their government. President Trump promised that these citizens would no longer be forgotten. But what about the unborn future taxpayers? Will they continue to be forgotten? That is the question for President Trump—and for all Americans.