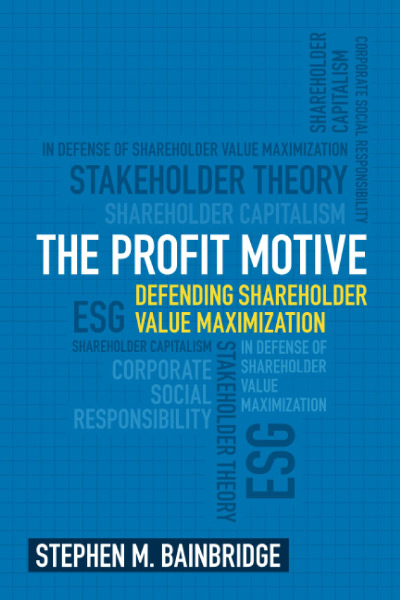

Stephen Bainbridge’s The Profit Motive: Defending Shareholder Value Maximization is both a welcome and valuable addition to a small but rapidly growing movement against efforts to add the varied and frequently unproductive interests of stakeholders to the existing responsibilities of corporate managers. Although debates regarding the right and salutary duties of private firms arguably go back over a century, the most recent clashes have focused upon the Environmental, Social, and Governance (ESG) and Diversity, Equity, and Inclusion (DEI) frameworks.

Contrary to commonly held notions, the modern dispute over corporate obligations did not begin with the Berle and Dodd debates in the Harvard Law Review in the early 1930s. Those did, however, delineate the parameters of the controversy. Emerging during a period of significant economic and social upheaval in the United States, in the aftermath of the 1929 stock market crash and at the onset of the Great Depression, the bone of contention in that exchange was not about the exclusive interests of shareholders over those of a broader group of interests. Indeed,

by the mid-1930s, legal doctrine and scholarship in the United States had developed a sophisticated account of the issues pertaining to the maximands of corporate governance. The most important achievement of [this] analysis is their pointing out the core problem, which is the absence of a coherent system with which the competing interests of corporate constituencies could be furthered—or at least reconciled—by corporate agents. The problem continues to haunt corporate governance to this day (p. 56).

The deliberation re-emerged in the mid-twentieth century. The civil rights movement, a quickening drumbeat of corporate mergers and acquisitions (in particular the appearance of conglomerates), and growing environmental activism led to increased scrutiny of corporate practices and their impact on society. Milton Friedman’s essay "The Social Responsibility of Business is to Increase its Profits," published in the New York Times Magazine in 1970, was a direct response to an intensifying public demand for corporate social responsibility (CSR), suggesting that business executives should include the interests of various stakeholders, including employees, customers, activists, and their local communities alongside those of shareholders.

Friedman argued that the primary responsibility of corporate executives is to maximize shareholder value within the bounds of the law and ethical custom. He contended that forcing firms to address social causes was essentially the public conscription of private resources, and that social issues are more appropriately addressed by governments and individuals. The reasoning resonated with many business leaders and economists, reinforcing the notion of shareholder primacy that had gained traction in previous decades, though never fully convincing many in the broad public. The essay sparked significant debate and criticism, though, renewing discussions about the role of corporations in society which remain unresolved to this day.

Bainbridge’s perspective is clear from the start of the book and never wavers: not only is the maximization of shareholder value required by law, it is also what ought to be required by law.

The organization of the book is straightforward. After standardizing definitions in the introduction, the book lays out the case against stakeholder theories in two large sections. The first section examines what is required by law as illustrated in a handful of precedent-setting cases. The focus here is whether current corporate law permits or even mandates corporate management to prioritize certain external interests over those of stockholders. The second section, “Merit,” builds toward the conclusion that corporate managers and executives are skilled in business operations, not in advancing societal objectives. Shareholder primacy is superior to stakeholder capitalism for many reasons, a fundamental one being that corporate managers lack the necessary expertise and tools to identify, prioritize, and address complex political issues.

Corporate managers, despite the considerable expertise they display, are fundamentally ill-equipped for purposes beyond serving their corporate mandates. Bainbridge exemplifies this with a basic, but familiar, scenario: the shutdown decision. Should an obsolete facility or division be closed or liquidated? Doing so benefits shareholders (as well as customers and creditors) but is likely to result in job loss and community disruption among other knock-on effects. Thus, the simple matter of diverse constituencies and their frequently irreconcilable interests highlights the impracticality of stakeholder capitalism. Shareholder-centric operation, Bainbridge points out, makes such choices immediately tractable. It also makes those decisions predictable, which is socially beneficial as well. The stakeholder model, realized, would additionally permit business managers to pursue personal agendas with firm resources under the guise of balancing interests. The question of whose values should guide those decisions only further complicates the issue.

Despite the tiresome accusations of “greed” and “selfishness” levied at corporations with shareholder wealth maximization goals, their social dividends are both considerable and easily missed. Economic calculation, accomplished exclusively through the working of the price system, ensures that choices as to the use of labor, capital, raw materials, and time itself are carefully considered and employed. This mechanism allows for the precise assessment and coordination of inputs to maximize their productive potential and satisfy consumer demands most effectively. Profit-driven firms are more successful in attracting labor, capital, and raw materials: as they prioritize and respond to consumer demands, they work to optimize their use of inputs. The generation of profit is nothing if not a critical motivator for entrepreneurial alertness, which on a macroeconomic scale fosters economic development, increases productivity, lowers prices, and contributes to increasing standards of living.

Perhaps least appreciated of all, the undistracted pursuit of shareholder wealth maximization feeds into political and social freedom. When individuals engage freely in business and trade where innovation and commerce thrive, wealth and opportunity follow. The rising tide reduces dependency on government support and increases autonomy. A civilization undergirded by economic robustness is, ceteris paribus, better able to advocate for its political rights; simultaneously, a strong economic foundation erodes the ability of states to suppress its citizens.

A particularly interesting portion of the book comes in its brief discussion of Benefit Corporations (“B Corps”), a type of for-profit corporate structure created in the early twenty-first century. The goal of the B Corp is explicitly to hold firms organized in this manner accountable to stakeholders in addition to shareholders. Unlike traditional corporations, these were created in response to growing concerns about the limitations of traditional corporate structures that prioritize shareholder profit above all else. As such, B Corps are legally mandated to consider the impact of management and executive decisions on workers, suppliers, the local community, the environment and beyond alongside shareholders. Benefit corporations are held to higher standards of accountability and transparency and undergo frequent assessments to ensure their adherence to those broader interests. It is a structure which in its fundamental indenture seeks to align a firm’s mission with long-term sustainable practices, building trust and loyalty among consumers, employees, and investors while trying to ensure a wider than normal interpretation of corporate responsibility.

If, like me, you had never heard of a B Corp before, you are to be forgiven; despite a slim handful of high-profile examples (Ben & Jerry’s and Patagonia among them), two decades into their existence they remain a rarity among corporate forms. That in turn begs the question: Why? A serviceable (and probably obvious) working hypothesis: firms organized and run explicitly to pursue profits are more wealth-producing, with further reach and more efficient operation, than those organizationally predicated upon dividing their efforts between stakeholder and shareholder interests. A prospective shareholder is also more likely to favor investments where the oversight of their contributed capital is the singular emphasis of managers, rather than one in competition with outside interests.

The Profit Motive robustly challenges the principles of stakeholder capitalism, offering economists, business practitioners, law students and professors alike an exploration and vindication of the philosophy that corporate officers are best and rightly focused on the sole purpose of maximizing shareholder wealth. The curious enthusiasm which long-time ideological opponents of business and markets have in recent years directed at co-opting the dynamism and wealth production of private firms can not only be spurned on a legal basis: it should be, on economic and ethical grounds.

| Other Independent Review articles by Peter C. Earle | |

| Spring 2024 | Conservation, Ecology, and Growth in For a New Liberty |

| Spring 2021 | The Origins and Political Persistence of COVID-19 Lockdowns |