The eventual toll from COVID-19 is impossible to predict. No economic calculation of the priceless human lives that have succumbed to this terrible disease is possible. But we ought to be thankful that the economic system is resilient in a way that the human body is not. Fortunately, the economic damage from an epidemic is largely unrelated to the very serious and tragic number of deaths.

Containment and quarantine efforts mean production shutdowns, and they now are underway everywhere. But they represent supply-side disruptions, very different from conventional “recessions.” As explained in this Executive Summary, such events need not cause much cumulative loss of output—except to the extent that it is self-inflicted. The most likely cause of a recession, if we are to have one, is over-zealous efforts to slow the spread of disease by interfering with economic life. Rather than coming together, the political parties are out-bidding one another, striving to be seen by the public as proposing the more extreme policy. The police powers of the state are likely to be invoked and expanded to enforce those policies, which impose excessive and indiscriminate constraints on economic freedoms and—going forward—bigger and more authoritarian government.

The Role of “Fear Itself”

Panic, shock and awe are all part of the equation. As the media know, the public is spooked by potent words. When the World Health Organization, hitherto cautious, declared that the virus threat had become a “pandemic” it triggered one of several stock-market plunges.[1] Pundits and attention seekers undermine stability when they speak of a “coronavirus recession.” As fears escalate, the distinction between a health crisis and an economic crisis becomes blurred. Some professional economists, usually careful to wait for evidence, declare an emergency.

Joining the melée, the Federal Reserve has acted to violate its own policy of forward guidance, again and again, hitting investors with shock and surprise. Stock markets have shrugged off the unprecedented scale of monetary easing rather than being awed by it. But when something doesn’t work, the government’s reaction is often to intensify the effort to “do something.” Fed actions have encouraged disorientation and panic and, in a vicious cycle, each jump in pessimism has drawn forth more extreme monetary and fiscal action.

The Economic Profile of a Natural Disaster

You might expect the growth of the economy to have been declining day by day. Until very recently, though, you would have been wrong. The figures are in flux, but until the last week of March, quite the opposite was happening, according to immediate factual news on the US economy from the Atlanta Fed’s GDPNow website.[2]

As the crisis began to unfold, GDPNow estimated first quarter growth at about 2.5 percent, compared with the usual consensus view of around 1.5 percent from the Blue Chip forecasters. From then on Blue Chip’s consensus has slipped. But data coming in from the actual economy pushed up the GDPNow estimate above 3 percent (as of late March). Only then did widespread business shutdowns kick in. With 90 percent of the quarter already behind it, the economy had accelerated substantially from last year. And, in both January and February, employment rose by an unusually large 270 thousand jobs.

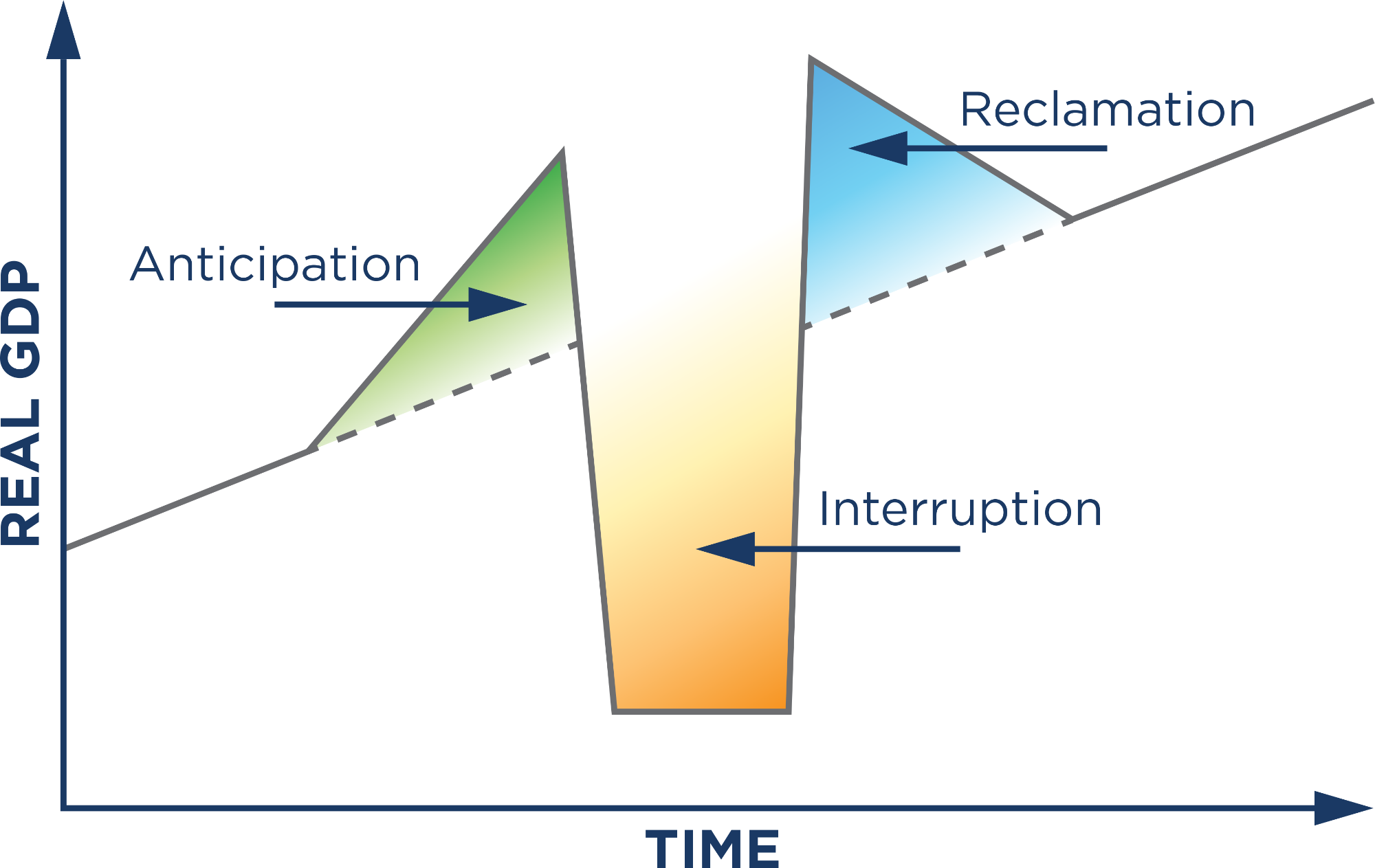

Why? It’s the first stage of the theoretical profile shown in Exhibit 1. With plenty of warning that the virus was about to spread to the United States, pessimism caused pundits to move in one direction and the economy itself to move oppositely. In the first twelve weeks of the year, anticipating more difficult conditions ahead, business has boosted production and built up its stocks of raw materials and unfinished goods. Consumers have stockpiled their requirements too.

Exhibit 1: Stylized Profile of a Hiatus in Economic Activity

The growth trajectory in Exhibit 1 has the shape it does because a production interruption destroys no physical capital.[3] Nor is the incentive to restore normality harmed. All too few remember the natural adaptive abilities of a free-market economic system to adjust in even the direst circumstances. In the aggregate, gaps in the flow of goods and services are filled by a mix of pre-emptive efforts and ex-post rebuilding. Output dips and vitality are redistributed across sectors. Winners and losers emerge, but there’s no natural reason to fear economic damage beyond that.

Exhibit 2: Postwar Intercontinental Epidemics and US Recessions: No Concordance

Long-term experience confirms the disconnect between pandemics and recessions. As Exhibit 2 demonstrates, no evidence exists that one implies the other.

If output is disrupted in one period, it will be restored in another—albeit perhaps in a different form. That is the logical result of an equilibrium-seeking economy.[4]

True, services cannot be stockpiled as goods can, and they represent four-fifths of GDP. But that need not weaken the profile in Exhibit 1. The goods market and the market for services are connected intimately by the market-price system. Substitution effects between and within them can help the economy adjust to constraints. Most households can choose to eat and drink at home rather than dine out, while vendors of many services can choose to travel less and text or telephone customers more. In any case, large segments of the services sector are run by physical capital (electric power, for example) or humans working at a distance. Those activities are less subject to shutdowns. Mostly, it is services generated by humans working together in close proximity that suffer the most: travel, entertainment, restaurants and taverns and—in bitter irony—healthcare.

A manufacturing labor strike exemplifies the anticipation of, and recovery from, a shutdown. Foreseeing a strike, producers and supply chains expand production and build up inventories until it hits. After a strike ends, production needs to be boosted again. A famous example occurred back in September of 1970 when General Motors, at that time the largest US employer, was struck for 67 days.[5] The nation’s real GDP accelerated in the third quarter despite the walkout, then declined 4.2 percent (annualized) in the fourth. Finally, it rebounded at an 11.3 percent annual rate in the first months of the new year. In the end, no detectable net loss of economic activity materialized.

Conclusion

Anxiety and economic damage are related only distantly to one another. We cannot scare ourselves into a recession unless the panic causes major governmental policy mistakes or futile attempts to “plan” our way out of the economic damage. For example, how does anyone know that General Motors is the best producer of ventilators? Maybe it’s lawnmower manufacturers! It’s easy to forget that efforts to combat economic or natural disasters and recover are a form of production, in some ways promoting more economic activity and offsetting losses. Epidemic containment efforts and precautionary preparations come under that heading. When it can, the private sector ramps up production and builds inventories in anticipation of shutdowns yet to come.

Partly reflecting the same mechanism, GDP is estimated to have grown at more than a 3 percent rate until shutdowns set in near the end of the first quarter of 2020. The worst quarter looks to be the second. But after the production shutdowns end, GDP will shift back above pre-crisis trend as businesses and consumers make up for lost time. Events do not as yet add up to a significantly weaker full-year performance for the US economy. Economic activity will go into hiatus, but it can be made up quickly once the crisis is over. All of this is natural resilience; Washington was ill-advised to misdiagnose the economic threat of the pandemic, to rely on worst-case epidemiological scenarios and to interfere with futile demand-side “stimulus.”

The view taken by the media and in government is different. Panic is in the ascendant. Sheer repetition is creating belief in a “coronavirus recession” that governments treat with enormous doses of easy monetary and fiscal policies. They may ease the pain temporarily, but they are unwanted by the markets and not useful for combating supply-side disruptions. Over-zealous efforts to quarantine and delay the spread of disease could create an unnecessary, man-made recession. And, as with every major war, the US will emerge from this crisis with a larger and more authoritarian central government unlikely to be scaled back afterwards.

Notes

[1] WHO has no formal definition for a pandemic.

[2] https://frbatlanta.org/cqer/research/gdpnow.aspx.

[3] In the present case, the stock of human capital is not threatened either, as those most vulnerable to the virus are less likely to be members of the workforce.

[4] The mechanism borrows from LeChatelier’s Principle in chemistry, that systems adapt to constraints in whatever way minimizes the distortion.

[5] For a personal account, see Judy Putnam, “Remembering the GM strike from 1970,” Lansing State Journal, September 17, 2019.