The Lighthouse® is the weekly email newsletter of the Independent Institute.

Subscribe now, or browse Back Issues.

Volume 13, Issue 42: October 18, 2011

- Europe’s Woes Prompt Fears of a U.S. Bailout

- ‘Regime Uncertainty’ and the Economic Malaise

- EPA Inspector General Challenges Agency Findings

- Independent.org Unveils New Multimedia Section

- New Blog Posts

|

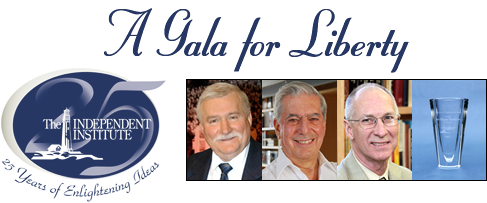

Please join with us to celebrate The Independent Institute’s 25th Anniversary Dinner: A Gala for Liberty, November 15th, at the Ritz-Carlton in San Francisco. Honorees Lech Walesa, Mario Vargas Llosa, and Robert Higgs will be presented with the Alexis de Tocqueville Award as champions of individual liberty, entrepreneurship, personal responsibility, civic virtue, and the rule of law.

Worried that Europe’s sovereign debt woes could worsen his prospects for reelection, President Obama is urging European leaders to craft a rescue plan to save Greece and other countries at the brink of a fiscal meltdown. Moreover, Europe’s financial troubles have long worried U.S. policymakers. In 2008 and 2009, for example, the Federal Reserve discreetly gave billions of dollars to European institutions. But Obama’s prescription won’t cure Europe’s ailment, according to Alvaro Vargas Llosa, senior fellow with the Independent Institute’s Center on Global Prosperity.

“By some estimates, if Greece defaults and the European banking system seizes up, some $3.5 trillion will be needed to recapitalize the troubled banks,” Vargas Llosa writes in a piece for Forbes.com. “Does anyone seriously think the Europeans alone will foot that bill when the day of reckoning comes?”

Obama urges European leaders to decide on a rescue plan before the G20 finance meeting in Cannes in early November. He believes that a default by Greece could make a default by Portugal and other countries more likely, which in turn would weaken the U.S. economy as the country gears up for the 2012 election. And if that outcome seemed likely? “The White House then will decide that the United States has to rescue Europe in order to rescue itself,” Vargas Llosa writes. A U.S. bailout of Europe would be a risky political move that the White House would undertake with great reluctance, however, because, Vargas Llosa notes, “Americans already are disgusted with the amount of money spent to bail out their own institutions.”

Do Obama’s Re-Election Chances Ride on a U.S. Bailout of Europe?, by Alvaro Vargas Llosa (Forbes.com, 10/11/11)

Lessons from the Poor: Triumph of the Entrepreneurial Spirit, edited by Alvaro Vargas Llosa

Robert Higgs, the Independent Institute’s senior fellow in political economy, argued in a 1997 paper (reprinted in his book Depression, War, and Cold War) that New Deal laws, regulations, and court decisions prolonged the Great Depression by making the political and legal climate so rife with uncertainty that private investors were discouraged from taking the steps that would have put the economy on the road to recovery. One piece of evidence he presented came from the bond market: the spread between the yield on longer-term corporate bonds and the yield on bonds due in one year soared in the mid 1930s and stayed high until 1942. That spread measures the perceived risk of collecting the interest promised, and it closely tracked business leaders’ perceptions that New Deal policies and court decisions weakened property rights. More recently, Higgs has argued that “regime uncertainty,” as he calls it, also helps explain our current economic malaise. Moreover, new research by economists at the University of Chicago and Stanford supports his claim.

The economists—Scott R. Baker, Nicholas Bloom, and Steven J. Davis—have constructed an index that combines three types of information: newspaper articles that refer to policy-related economic uncertainty, prospective changes in the level of taxes, and the extent of forecasters’ disagreements about future inflation and government spending. By creating an index that goes back several decades, the three economists were able to establish that business leaders hesitate to hire many workers or invest heavily to expand output when faced with uncertainty about taxes, health-care costs, and new regulations.

Writes Higgs: “These analysts have met the challenge of producing a systematically measured quantitative index of regime uncertainty (they call it policy uncertainty) over a long period, and they have presented reasonable arguments that tie the index’s movements to specific policy measures and future possibilities.” Higgs invites his critics, such as Paul Krugman, to examine the work of these economists, but he is confident that it will hold up to honest scrutiny.

Important New Evidence on ‘Regime Uncertainty’ and Government Failure, by Robert Higgs (Big Government, 10/12/11)

Depression, War, and Cold War: Challenging the Myths of Conflict and Prosperity, by Robert Higgs

In 2007, the U.S. Supreme Court narrowly ruled that the Environmental Protection Agency was authorized to regulate greenhouse gases if it could show that carbon dioxide was a threat to human health and welfare. Two years later the EPA issued a report, called an Endangerment Finding (EF), intended to support its claim that CO2 is a “pollutant” under the Clean Air Act. But something happened last month that jeopardizes the EPA’s authority to regulate greenhouse gases, explains Independent Institute Research Fellow S. Fred Singer.

In September, the EPA’s Office of Inspector General found that the EPA’s Endangerment Finding did not meet federal data-quality standards: the procedure that led to the report, as described in its Technical Support Document (TSD), lacked transparency and complete independence from the agency.

“The lack of an independent analysis of the science underlying the EF puts the burden right back on the soundness of the science used by the IPCC, which is the main source of the TSD,” Singer writes. The IPCC, an international body of scientists that issues influential reports on climate change, has not reviewed temperature data since its 2007 assessment, but after it examines the new data, Singer expects the flaws in the EPA’s claims to become even more apparent. “It is unlikely, therefore, that the EPA’s TSD will stand,” Singer continues. “And without the TSD, the Endangerment Finding is toast—and so is regulation of carbon dioxide.”

EPA’s CO2 Endangerment Finding Is Endangered, by S. Fred Singer (American Thinker, 10/15/11)

Video: Hot Talk and Cold Science of Global Warming, featuring S. Fred Singer (7/14/11)

Hot Talk, Cold Science: Global Warming’s Unfinished Business, by S. Fred Singer

We are delighted to announce that the Independent Institute has just unveiled a multimedia section on its website. Now you can easily find the latest video and audio posts from our television, radio, and event appearances!

Already, our production team has posted clips from 118 television appearances, 24 radio appearances, 24 event appearances, and 3 exclusives from Independent Institute TV.

The latest additions to the multimedia section include Anthony Gregory on the ramifications of the assassination of Anwar al-Awlaki (KTVU-TV), David Theroux on life in libertarian society (Stossel), and Benjamin Powell on federal financial irresponsibility (Freedom Watch). Please visit the section frequently, as we are constantly adding new and vintage clips from the Independent Institute.

Independent Institute Multimedia Section

New Blog Posts

From The Beacon:

Further Thoughts on Herman Cain’s 999 Plan

Randall Holcombe (10/15/11)

Magna Carta 2011

Mary Theroux (10/15/11)

Nordhaus on Monetary Reform

Peter Klein (10/14/11)

Herman Cain’s 999 Plan

Randall Holcombe (10/14/11)

Internet Taxes

William Shughart (10/13/11)

Can Big Government Be Rolled Back?

Carl Close (10/11/11)

From MyGovCost News & Blog:

A Fresh Perspective for Occupy Wall Street

Emily Skarbek (10/16/11)

The ‘Buffett Tax’: Why 5.4%

Craig Eyermann (10/13/11)

Gallup Poll’s Chairman: Don’t Look to Washington for Jobs

Stephanie Freedman (10/11/11)

The Independent Institute’s Spanish-language blog has surpassed 3 million page views! You can find it here.