The lengthy title of Nobel-laureate Vernon Smith aptly captures a reality that too many economists, policy makers, and bewildered voters fail to grasp: The economic function of inflation is to lower the real value of wealth assets sufficiently to pay for the government's excess spending monetized by the Federal Reserve.

Article

Inflation has, in modern history, two and only two causes: first, the federal government spending more than it collects in taxes; second, full central bank accommodation of the spending in its willingness to buy in the open market whatever amount of treasury bonds is needed to enable private lenders to be willing to hold the new issue. In effect the central bank (the U.S. Federal Reserve) is financing the treasury issue even though it is prohibited from doing this “directly,” so it must be achieved indirectly. But a rose by any other name would smell the same.

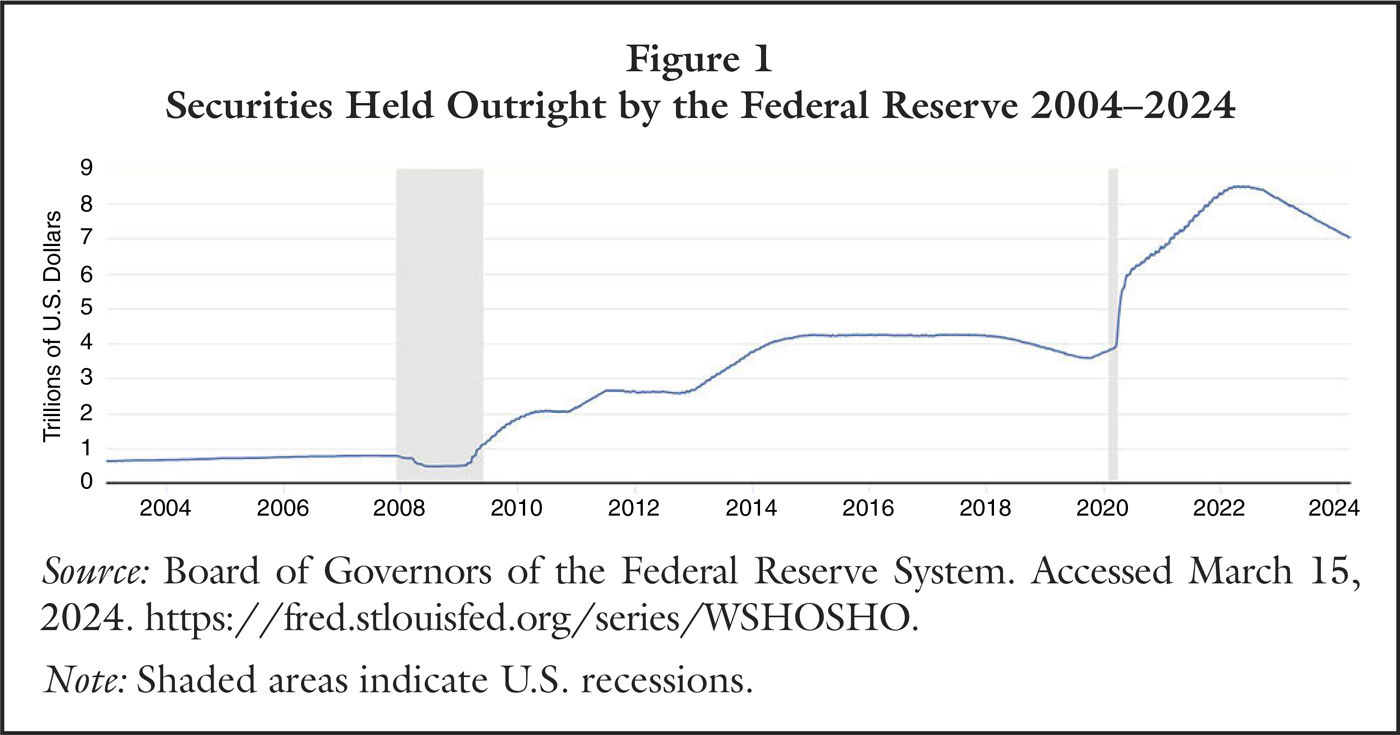

Figure 1 shows the size of the Federal Reserve balance sheet expansion made necessary by the recent government excess spending, which is also a measure of the corresponding new demand deposit money created in the process.

Observe that the big monetary bump in 2020–2022 completely dwarfed Federal Reserve open market purchases following the Great Recession. The minirecession of 2020 was due to the external COVID lockdown shock in reduced output, not to insufficient demand in the economy as in the Great Recession.

So, policy “stimulus” was the problem, not the solution.

Since October 2008, the Federal Reserve has discretionarily “neutralized” its government bond purchases by buying them, not for their own account—which would create new reserves for the banks, enable them to lend more, and be still more inflationary—but rather for the account it manages in the name of the treasury. In case you didn’t notice, this means the treasury’s banker is buying them for the account of the treasury, its customer.

Because the Federal Reserve creates the new demand deposit money required for these purchases, the necessary consequence is price inflation.

How much inflation? That is easy to state in economic principle, which should guide our thinking as to how long and far it will likely endure: Inflation will lower the real value of assets by whatever amount is necessary to pay for the resource cost of the original government excess spending. If the excess spending and money created is $3 trillion, then this real resource cost is what the economy must find a way to pay for out of reduced asset value.

For some assets, like inventories of corn, paper towels, and houses that are also consumer goods, their prices will reflect that inflation, and so may not suffer any decline in real value. But the economy will find $3 trillion in assets from which it can extract sufficient real resources to pay for the excess spending. These will be all assets whose annuity payments are stated in fixed dollars at the time of contract. All bonds—federal, corporate, state. Also, all lease, rental, and insurance contracts. Real resources must come from somewhere, otherwise there would be a massive free lunch for the government to consume.

All modern governments pretend that they can create enough demand deposit money to enjoy a free lunch. But the private sector economy, including me and you, pay in terms of lost asset value. Indeed, an important function of the economy is to find the resources to pay for whatever shortfall was created jointly by the government and its dutiful handmaiden, the central bank.

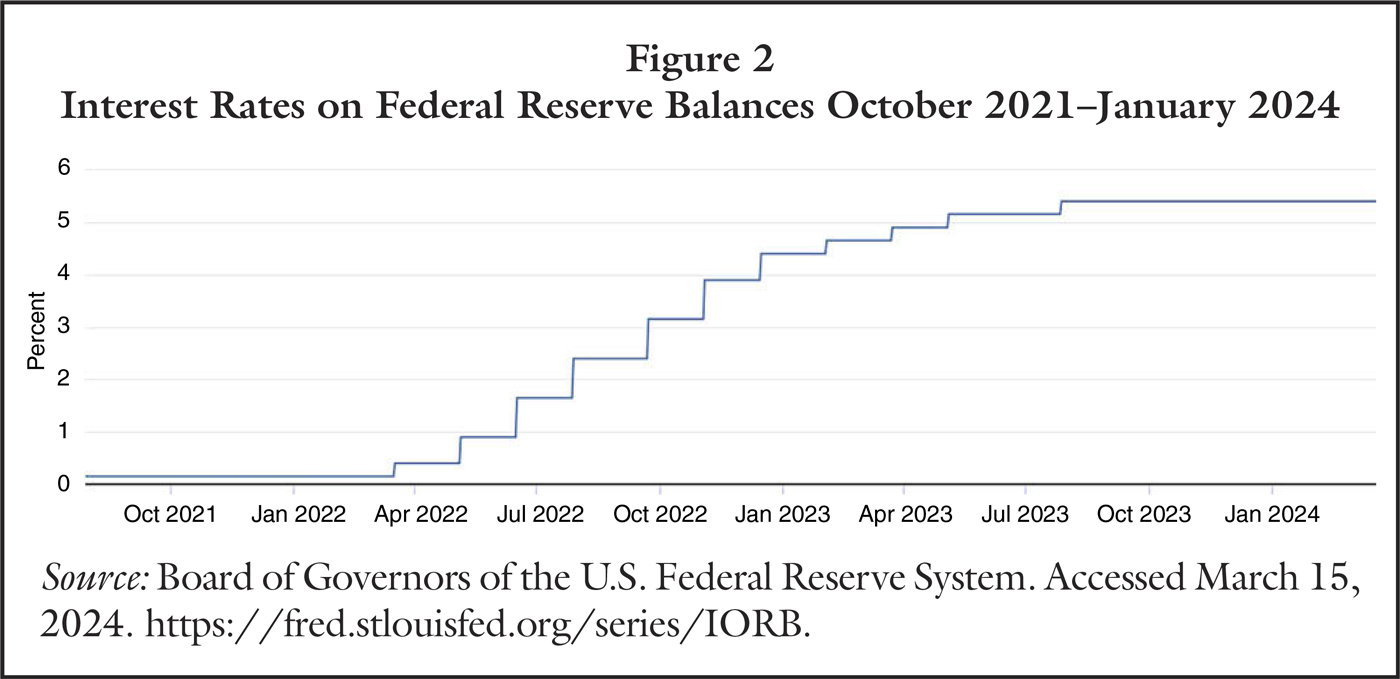

The Federal Reserve, having caused the current inflation, has been much in the news for courageously trying to stop it, by cranking up a long series of increases in the rates they pay banks for holding reserve balances instead of using it for making new loans. Translated, that means the Federal Reserve is trying to shift some of the cost of the required total asset value reduction into reducing net new investment additions. These rate increases are shown in figure 2.

In summary, inflation is caused by government excess spending financed by new money its central banker creates. To stop the consequent inflation, the Federal Reserve takes actions designed to raise the interest rate it pays the private banks not to make loans, thus shifting some of the burden of reducing asset wealth value into reducing net new investments.

I suggest that the Federal Reserve start following a policy of not causing inflation in the first place. Let any needed government new bond issue find a lower market price and higher corresponding interest rate that will induce the public to buy its additional debt. This will allow the public to voluntarily determine and discipline the extent to which the excess spending will be accommodated. As it stands, there is now no effective budgetary discipline of government excess spending. Whatever the government spends is financed with the creation of new money, with its real resource cost subsequently extracted from the private product sector asset values through inflation. Government grows because it is restrained by no budgetary discipline.

For those who want a wealth tax, you already have long had it.

| Other Independent Review articles by Vernon L. Smith | ||

| Winter 2024/25 | The Road to Freedom: Economics and the Good Society | |

| Summer 2023 | Adam Smith, Sociality, and Classical Liberalism | |

| Summer 2020 | Classical Economics: Lost and Found | |

| [View All (5)] | ||