For three generations, U.S. conservatives have vowed to restrain the federal leviathan. Their main electoral vehicle has been the Republican Party (GOP), whose politicians perennially condemn the Democrats’ spendthrift recklessness. It is time to reexamine this movement history because the alleged alternative to the current president’s politics is the GOP.

Talk of reviving Reaganism has returned. Both fans and detractors assume that Ronald Reagan’s GOP pushed an agenda of cutting spending, gutting welfare budgets, and upholding individual responsibility over communitarianism.

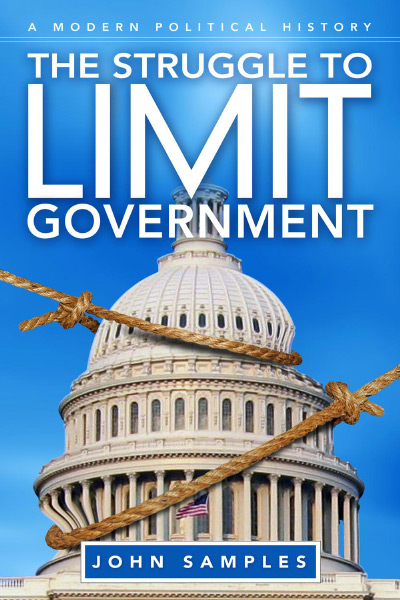

John Samples’s new book, The Struggle to Limit Government, at once embraces and challenges this narrative. Samples tells the back story of the current “regime,” casting the Democrats as the active proponents of big government and the Republicans as passive or secondary culprits—except for Reagan and his followers, who are described as genuine, if very nuanced, supporters of limited government. The story Samples tells, however, appears to undercut this qualified thesis because, as he clearly shows, the Republicans, even during Reagan’s presidency, never demonstrated much genuine interest in constraining government.

The book begins with the Progressives, recalled through intellectuals such as Herbert Croly, a “prophet preaching moral decay [as well as an] intellectual promising reasoned renewal” (p. 4). They wanted an active state “charged with fighting monopolies” (p. 10) and reforming domestic life, and they were dedicated to “the value of a good war” (p. 6).

The Progressives obtained power under President Franklin Roosevelt, whose New Deal created the “old regime” under which Americans still live. Although the New Dealers radically expanded welfare, they did not overthrow American values: “Keynesianism did not seek to change Americans” fundamentally (p. 12). Social Security began with the “illusion of individual responsibility” (p. 13), although its architects “assumed from the start it would not be self-financing in the long run” (p. 14).

The Great Society solidified this old regime, advancing its reach into American culture. President Lyndon Johnson increased financing for academia and the media, which henceforth would reliably support Washington, D.C. He signed the Civil Rights Act, which partially nationalized private property nationwide, although Samples writes that the act “appeared constrained in aspiration” (p. 26). After flirting with tax cuts, Johnson adopted tax hikes to finance his expensive programs. Even the president’s war in Vietnam was seen as “a crusade to bring the New Deal to Southeast Asia” (p. 30).

President Richard Nixon “thought blue-collar Democrats could be turned into Republican voters by continuing to expand the New Deal’s welfare state” (p. 42). This strategy entailed extending taxes, aggrandizing the Occupational Safety and Health Administration, creating the Environmental Protection Agency, and establishing textile quotas and wage-and-price controls. “Between 1970 and 1975, Social Security expenditures more than doubled” (p. 46), and “Congress passed more regulatory programs from 1969 to 1974 than during any other era in American history, including the first five years of the New Deal” (p. 43).

In the late 1970s, memories of Vietnam and Watergate as well as Keynesianism’s failure to explain, much less cure, stagflation led to widespread distrust of the federal government. Enter Ronald Reagan, who resonated with a public that “still espoused liberty and limited government” (p. 51) and had yet to accept “redistribution of wealth as a means to equality of condition” (p. 67).

Samples seems charitable toward Reagan: “Ronald Reagan sought to limit government” (p. 3) and “favored the individual over government” (p. 78). Yet he concedes that “the Reagan campaign did not actually intend to reduce federal spending” (p. 80), that “increasing liberty was not the goal of” Reagan’s economic agenda (p. 81), and that “Reagan from the start was primarily a reformer of the old regime” (p. 82). Even the administration’s rhetoric was inconsistent. In an early speech, Reagan defended “the social safety net that supports ‘those who through no fault of their own must depend on the rest of us, the poverty stricken, the disabled, the elderly, all those with true need.’” Reagan had no plan to cut “Medicare; Social Security; veterans’ pensions; free school lunches for the poor; supplemental income for the blind, aged, and disabled; Project Head Start; and summer youth jobs” (p. 84).

Reagan supported or allowed increases in most spending programs and even sponsored sharp increases in defense spending. During his presidency,

[f]ederal spending on highways increased in real terms by 3 percent. . . . Education programs for the handicapped grew by 50 percent in real terms. Biomedical research sponsored by the National Institutes of Health grew by 47 percent. Basic science supported by the National Science Foundation rose by 38 percent. The safety programs and general operations of the Federal Aviation Administration increased by 36 percent. Funds for the federal prison system rose by 206 percent. The Women, Infants, and Children’s program that provides nutritional assistance to pregnant women and newborns increased by 54 percent after inflation. The budget of each of these programs grew faster than defense during the Reagan years. Spending on agricultural subsidies also rose more than any of these discretionary items. Over the eight years [of the Reagan administration] . . . spending on farm subsidies went up 252 percent. Spending on welfare increased 44 percent during those same eight years. (p. 143)

What’s more, “[b]etween 1980 and 1987, the three largest social welfare programs (Social Security, Medicare, and other health care spending) increased their spending by 84 percent” (p. 145).

The most significant cuts amounted to a few billion dollars in mass transit, urban housing, and similarly small programs. The Reagan administration also made (mostly unsuccessful) attempts to promote watered-down federalism and institutional incentives for balanced budgets.

Reagan did oversee large reductions in marginal tax rates, but “[h]is tax-rate cuts were followed by tax increases” (p. 115). He increased Social Security taxes, closed tax “loopholes,” and shifted much of the tax burden to corporations or, through deficit spending, to future generations. Borrowing was used “to an unprecedented degree.” Reagan’s supposed strategy was to starve the beast through tax cuts, but “later studies indicate that cutting taxes does not reduce spending in general” (p. 148).

The Struggle hardly deals with Reagan’s war on drugs or his foreign-policy adventures. At any rate, given his failure to cut government, his inconsistent rhetoric, and his unmentioned record of expanding California’s bureaucracy as governor, it seems inappropriate to treat him as even a qualified champion in the “struggle to limit government.” Perhaps Reagan improved public ideology by “disrupt[ing] the prior consensus favoring a sharply progressive tax code, a consensus rooted ultimately in the politics of envy” (p. 149). But, as Samples notes, Reagan shored up faith in the regime, and “[p]olling responses indicate that the number of people who wanted government spending grew with each passing year in the Reagan presidency” (p. 150).

In much of the book, Reagan is upheld as a standard. Samples writes that “[t]he 1990 budget agreement marked the end of the Reagan presidency” (p. 141), but whether George H. W. Bush’s term signifies a true shift is questionable. “[T]he struggle for limited government would find its new general” in Newt Gingrich, “the true heir to Reagan’s legacy”(p. 160). But Gingrich’s 1994 “revolution” did not curb government, and from the beginning its Contract with America “remained silent . . . about constraining entitlement programs and spending” (p. 168). All in all, “[t]he politics for the Republican 1994 revolution are not especially pleasing to the devotee of limited government” (p. 182). This judgment seems to complicate the author’s description of Gingrich. One big success of the 1990s was supposedly in agricultural policy, but “farm aid actually increased after 1996” (p. 198). Another supposed beloved success was welfare reform, but, “[i]n some cases, benefits rose sharply from 1994 to 2000” (p. 195).

Although Reagan and the Reaganites failed to cut government, Samples argues that the GOP has since drifted from Reaganism: “In 1997, a post-Reagan Republican Party came into view, a party that would rule until 2006” (p. 205). The Republicans were now interested in “[p]unishing sin, not containing power” (p. 209), but how does this stance differ from the one inherent in Reagan’s drug war? George W. Bush and the neoconservatives are criticized for supporting nation building, No Child Left Behind, campaign-finance reform, and “compassionate conservatism,” yet this new batch of Republicans seems to differ only slightly from its immediate predecessors.

Samples apparently endorses the U.S. invasion of Afghanistan, which “related to al-Qaeda and hence to protecting the nation against terrorism” (p. 224). But even wars for “national security” have expanded government. “World War II,” writes Samples, “belied the aspirations of the administrative state” because “the experiences in Germany and Italy suggested unhappy possibilities for Americans if their state became too powerful” (p. 10). Yet a full account of modern government growth should illustrate this war’s centrality in creating and entrenching the “old regime” (see, for example, Robert Higgs, Crisis and Leviathan: Critical Episodes in the Growth of American Government [New York: Oxford University Press, 1987], 196–236, and Robert Higgs, Depression, War, and Cold War: Studies in Political Economy [New York: Oxford University Press, 2006], 3–123).

The close relation of war and government growth implies that the struggle to limit government must be tied to the struggle to limit militarism. The antiwar movement is not generally libertarian, but it is at least as relevant to achieving “limited government” as Newt Gingrich ever was. Is it true, as Samples contends, that “[t]he years 1981 and 1982 are the most important in the history of the struggle to limit government in the United States” (p. 115)? Perhaps the real history of this struggle has very little to do with any president’s agenda.

The Struggle to Limit Government contains fascinating discussions of shifting public opinion, partisan coalitions, reform attempts, interest groups, and politicking. Its accounts of the Progressive Era, the New Deal, and the Great Society are useful. Its treatment of Nixon and Reagan, the 1990s, and the George W. Bush years is sharp. Yet the author’s dispassionate analysis does not sit comfortably with his implied thesis. A radical rethinking of the conservative movement, such as Murray N. Rothbard’s The Betrayal of the American Right (Auburn, Ala.: Ludwig von Mises Institute, 2007), can help to provide context for the seeming paradoxes. Samples has made an important contribution to modern political history. However, with a Republican president, conservative politicians, and pro-military agitators as the protagonists, the story is not as climactic as the title.

| Other Independent Review articles by Anthony Gregory | |

| Fall 2014 | Rise of the Warrior Cop: The Militarization of America’s Police Forces |

| Fall 2012 | Understanding the U.S. Torture State |

| Summer 2011 | “The Tissue of Structure”: Habeas Corpus and the Great Writ’s Paradox of Power and Liberty |