Overview

Read Judge Napolitano’s Foreword.

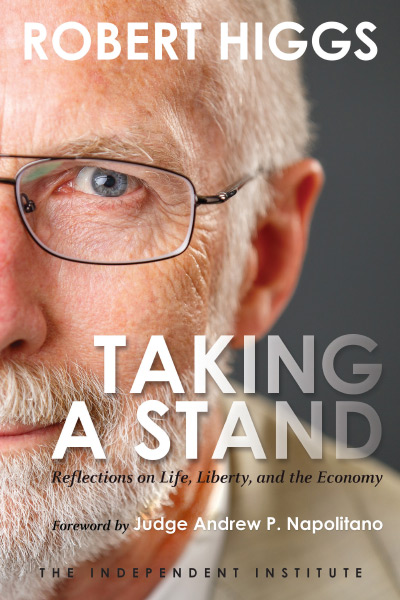

Renowned economist and historian Robert Higgs has pioneered a whole new understanding of the causes, means, and effects of government power and the need to deconstruct statism and re-establish institutions that protect and advance liberty, prosperity, and peace.

In the course of his work, he has completed seminal work on such issues as health care, the environment, law and economics, urban development, race discrimination, agriculture, immigration, war and peace, economic development, government spending and debt, welfare, money and banking, presidential power, civil liberties, the Great Depression, science, unemployment, and far more.

Now Taking a Stand offers the grand opportunity to make his vast insights available to general readers by combining his keen analysis with his engaging wit, humility and compassion in order to charm, educate and inspire people on the moral and practical imperative of individual liberty, entrepreneurship and innovation, peace, economic growth, personal responsibility, civic virtue, and the rule of law. Taking a Stand is organized into 99 short, accessible chapters to present a powerful and uplifting vision for the future.

Contents

Foreword by Judge Andrew P. Napolitano

Preface

Part I. Politics and the State

1. It’s Who You KnowPart II. On Doing Analysis in Political Economy

2. What’s the Point of Demonstrating?

3. Partisan Politics—A Fool’s Game for the Masses

4. Democracy’s Most Critical Defect

5. Nothing Outside the State

6. Consent of the Governed?

7. Why This Gigantic “Intelligence” Apparatus? Follow the Money

8. Can the Dead (Capitalism) Be Brought Back to Life?

9. The Welfare State Neutralizes Potential Opponents by Making Them Dependent on Government Benefits

10. The Systematic Organization of Hatreds

11. All Men Are Brothers, but All Too Often They Do Not Act Accordingly

12. Once More, with Feeling: Our System Is Not Socialism, but Participatory Fascism

13. Love, Liberty, and the State

14. Legitimacy

15. Political Problems Have Only One Real Solution

16. The Power of the State versus the Power of Love

17. State Power and How It Might Be Undermined

18. All Government Policies Succeed in the Long Run

19. Crisis of Political Authority? I Wish!

20. Ten Rules for Understanding Economic DevelopmentPart III: Money, Debt, Interest Rates, and Prices

21. Underappreciated Aspects of the Ratchet Effect

22. Diagnostics and Therapeutics in Political Economy

23. Can the Rampaging Leviathan Be Stopped or Slowed?

24. Higgs Is Just a Pessimist

25. My Question for the Doomsters: Then What?

26. Defense Spending Is Much Greater than You Think

27. Which End, if Any, Is Near?

28. Communism’s Persistent Pull

29. The Dangers of Samuelson’s Economic Method

30. Don’t Accuse Me of Blaming America When I Blame the Government

31. Extreme Aggregation Misleads Macroeconomists and the Fed

32. Why Do So Many People Automatically and Angrily Condemn Historical Revisionism?

33. Where Should the Burden of Proof Rest?

34. Politics and Markets: A Highly Misleading Analogy

35. Social Science 101: Three Ways to Relate to Other People

36. Ten Fallacious Conclusions in the Dominant Ideology’s Political Economy

37. Regime Uncertainty: Some Clarifications

38. Not Every Intellectual Gunman Is a Hired Gun

39. Truth and Freedom in Economic Analysis and Economic Policy Making

40. Austrian Economics—the Queen of the Experimental Sciences

41. Not All Countries Are Analytically Equal

42. Creative Destruction—The Best Game in Town

43. Thinking Is Research, Too!

44. Macroeconomic Booms and Busts: Déjà vu Once AgainPart IV: Investment and Regime Uncertainty

45. The Continuing Puzzle of the Hyperinflation that Hasn’t Occurred

46. Money versus Monetary Base: A Basic Yet Critical Distinction

47. The Euthanasia of the Saver

48. The Fed’s Immiseration of People Who Live on Interest Earnings

49. Extraordinary Demand to Hold Cash—the Mystery Persists

50. More Monetary Peculiarities of the Past Five Years

51. A Bogus Example of Controlling Inflation with Price Controls

52. Monetary Policy and Heightened Price Volatility in Raw Materials Markets

53. Regime Uncertainty: Are Interest-Rate Movements Consistent with the Hypothesis?Part V: Boom, Bust, and Macroeconomic Policy

54. Do the Post-Panic Changes in Corporate Bond Yield Curves Indicate Regime Uncertainty

55. The Great Divergence: Private Investment and Government Power in the Present Crisis

56. Private Business Net Investment Remains in a Deep Ditch

57. The Confidence Fairy versus the Animal Spirits—Not Really a Fair Fight

58. Important New Evidence on Regime Uncertainty

59. The Sluggish Recovery of Real Net Domestic Private Business Investment

60. Government Spending and Regime Uncertainty—A Clarification

61. World War II: Still Being Touted as the Quintessential Keynesian MiraclePart VI: Labor Markets

62. One More Time: Consumption Spending Has Already Recovered

63. U.S. Economic Recovery Remains Anemic, at Best

64. Likely Fiscal and Monetary Legacies of the Current Crisis

65. Counsel of Despair?

66. Unprecedented Household Deleveraging since 2007

67. An Overview of Recent Changes in Federal Finances

68. Will the Real Rate of Unemployment Please Stand Up?Part VII: Libertarianism

69. Short-term Employment Changes in Longer-term Perspective

70. Cessation of Labor Force Growth since 2008

71. Labor Markets Are Still in Bad Shape

72. Are Questions of War and Peace Merely One Issue among Many for Libertarians?Part VIII: Remembrances of Parents, Teachers, Colleagues, and Comrades

73. Freedom: Because It Works or Because It’s Right?

74. The Salmon Trap: An Analogy for People’s Entrapment by the State

75. Libertarian Wishful Thinking

76. “There Were Giants in the Earth in Those Days”—Genesis 6:4

77. The Rodney Dangerfields of the Ideological Universe

78. Classical Liberalism’s Impossible Dream

79. Why the Precationary Principle Counsels Us to Renounce Statism

80. Modern Communications Technology—Savior or Soma?

81. On My Libertarian Catholicity

82. William Jess Higgs (March 21, 1909 – October 15, 1977)Part IX: Just for Fun

83. Work in Progress: A Boy and His Mom

84. Murray N. Rothbard: In Memoriam

85. Jürg Niehans (November 8, 1919 – April 23, 2007)

86. Ronald Max Hartwell (1921–2009)

87. Manuel F. Ayau (1925–2010)

88. Joseph Sobran (1946–2010)

89. Morris David Morris (February 10, 1921 – March 12, 2011)

90. Siobhan Reynolds (1961–2011), a True American Heroine

91. Anna Jacobson Schwartz (November 11, 1915 – June 21, 2012)

92. Thomas S. Szasz (1920–2012)

93. James M. Buchanan (October 3, 1919 – January 9, 2013)

94. Armen A. Alchian (April 12, 1914 – February 19, 2013)

95. Robert William Fogel (July 1, 1926 – June 11, 2013)

96. Donald S. Barnhart (July 18, 1925 – September 8, 2009)

97. Mainstream Economists Will Have a Blast at This Year’s Halloween PartiesIndex

98. “American Pie”—Altered to Lament My Life and Times as an Economist

99. A Vulgar Keynesian Visits My Chamber

About the Author

Detailed Summary

- The welfare state neutralizes potential opponents: “As the ranks of those dependent on the welfare state continue to grow, the need for the rulers to pay attention to the ruled population diminishes,” Robert Higgs writes in Taking a Stand. “ The masters know full well that the sheep will not bolt the enclosure in which the shepherds are making it possible for them to survive.”

- Partisan politics is a fool’s game: “It’s all a fraud, designed to distract people from the overriding reality of political life, which is that the state and its principal supporters are constantly screwing the rest of us, regardless of which party happens to control the presidency and the Congress,” Higgs writes.

- Does the U.S. government enjoy the consent of the governed? Not for Robert Higgs: “For the record, I can state in complete candor that I do not approve of the manner in which I am being treated by the liars, thieves, and murderers who style themselves the Government of the United States of America or by those who constitute the tyrannical pyramid of state, local, and hybrid governments with which this country is massively infested.”

- Did federal policymakers botch the economic recovery after the Great Recession bottomed out in 2009? Absolutely. One way, according to Robert Higgs, was by proposing a good of new regulations, boosting government spending, and threatening to worsen the tax burden. The resulting “regime uncertainty” caused business leaders to postpone making major investments, thus ensuring that net private investment—the engine of economic production and job growth—would not return to its pre-recession peak anytime soon. “If mainstream analysts continue to disregard the role of regime uncertainty in the major depressions of the modern era,” Higgs writes, “then they will only demonstrate the poverty of their mode of analysis.”

- You can discern a lot about a person’s character by looking at who he chooses to revere. For Robert Higgs, some of those heroes are scholars such as James M. Buchanan, Murray Rothbard, Anna J. Schwartz, and Thomas Szasz; leaders such as Manuel “Muso” Ayau and Siobahn Reynolds; and especially his parents, William and Doris Higgs. “I didn’t need any commandment to honor my father and mother,” he writes. “It never occurred to me to do otherwise, in view of the examples they set.”

Robert Higgs may be the most outspoken scholar on the most pivotal development of our time: the growth of the state and the eclipse of individual liberty. Long known for his work on how national emergencies fueled the growth of American government and how the threat of state aggression can prolong economic stagnation, Higgs is equally insightful on the defects of Western democracy, the insidiousness of the welfare-warfare state, the mythmaking of political elites and entrenched bureaucrats, and the quirks and quacks of academia.

These strengths are on full display in Taking a Stand: Reflections on Life, Liberty, and the Economy, a collection of ninety-nine shorter pieces Higgs has written for the most part for The Beacon and The Independent Review over the past several years. Together, they show the depth and breadth of a writer who possesses both mastery over his subject matter and an uncanny knack for turning a phrase.

Readers will quickly perceive that Taking a Stand is Higgs’s most diverse and most personal book yet—and perhaps his most compulsively readable. The book delves into topics as far afield as the hypocrisy of America’s political establishment, the hidden causes of the U.S. economy’s post-2009 malaise, the challenges facing liberty’s advocates, Higgs’s own personal and professional heroes, and even his journey from the muddy economic mainstream to the clear waters of Austrian economics (written in hilarious verse, no less).

The following summarizes Taking a Stand, but readers should keep in mind that a brief rundown can offer only a selective look at this large and remarkable book.

Politics and the State

Taking a Stand kicks off with Robert Higgs’s devastating critique of widespread assumptions in Western political culture, especially rosy notions about democracy in America. In his first chapter, “It’s Who You Know,” Higgs exposes the oversized and largely neglected role that political elites have played in government policymaking, especially in defense and foreign policy. Using the example of Henry Stimson, a member of the cabinets of William Taft, Herbert Hoover, Franklin Delano Roosevelt, and Harry Truman, he argues that political elites almost always promote their own narrow interests at the expense of peace, prosperity, and liberty for ordinary Americans.

One reason that elites have dominated in a nation whose culture pays much lip service to self-rule, Higgs explains, is that the American people have swallowed a host of myths about “consent,” “legitimacy,” and “authority,” the subjects of other chapters in the book’s first section. The almost narcotic-like power of these myths helps explain why, for example, public protests against U.S. military adventurism have failed to bring about lasting change.

Ironically, the solution to most political problems may be for people to stop searching for political solutions altogether. Paraphrasing an infamous early member of the Black Panther Party, Eldridge Cleaver, Higgs writes: “You’re either part of the solution (by abandoning participation in politics) or you’re part of the problem (of endless political conflict).”

On Doing Analysis in Political Economy

In Part II of Taking a Stand, Higgs offers several insights at the intersection of economics and politics.

Economists have played a growing role in government policymaking since the midtwentieth century, a period when their discipline increasingly emphasized mathematical prowess and quantitative rigor. Unfortunately, both trends neglected important truths about the limitations of politics. As Higgs explains in his chapter “Ten Rules for Understanding Economic Development,” some of the profession’s worst shortcomings contributed to the travails of the poor in less-developed countries, who served as human guinea pigs for faddish policy prescriptions based on misdiagnosis of their economic ailments.

In subsequent chapters, Higgs explains that economists have also fallen prey to misconceptions about the growth of government during national crises—what he calls “the ratchet effect.” Try as they might, economists cannot fully understand this phenomenon without delving into what many seem to reflexively disdain: narrative history, with its emphasis on individual actors and their perceptions and motivations.

Similarly, economic and political analysts often hold naive notions about the march of big government. Many advocates of limited government, for example, offer “cures” such as a flat tax, term limits, constitutional amendments, and the abolition of the Federal Reserve. Unfortunately, these prescriptions (taken alone or together) fail to address the role of ideological change and therefore, according to Higgs, would prove futile in constraining Leviathan.

Money, Debt, Interest Rates, and Prices

Macroeconomists try to focus on the forest rather than the trees, but too often they suffer from a myopia that impairs their ability to grasp important relationships of economic cause and effect. Moreover, according to Higgs, their simplifying assumptions and overly aggregative framework often lead them to overlook key drivers of the business cycle: short-sighted monetary policies that induce malinvestment and destabilize the economy.

They also usually fail to appreciate that when investors and business leaders have doubts about the security of property rights and economic liberties, the consequences can be disastrous for economic recoveries. Indeed, such uncertainty likely boosted the demand for cash holdings following the financial debacle of 2008–2009. Fortunately, this helped prevent hyperinflation from materializing in the wake of the Federal Reserve’s massive increases in the monetary base and policy of pushing interest rates near zero (a policy that, Higgs explains, severely penalized all who live on interest earnings).

Investment and Regime Uncertainty

In 1997, Robert Higgs wrote a major article for The Independent Review (reprinted in his collection Depression, War, and Cold War) in which he showed that the Great Depression lasted so long largely because investors and business leaders were discouraged from making investments due a series of New Deal policies and court decisions they feared had weakened property-rights protections. He calls this phenomenon regime uncertainty, and his thesis has garnered much interest in the academic and business worlds.

In Part IV of Taking a Stand, he clarifies various misconceptions about regime uncertainty and also shows how the concept helps explain the sluggishness of the post-2009 economic recovery. The questions he answers sound esoteric, but they have profound consequences for economic growth and employment.

Higgs also sheds light on one of the economy’s leading indicators: changes in private investment. This elucidation helps explain why total output and employment did not quickly recover after the economy bottomed out in 2009, and it reveals fundamental flaws of Keynesian macroeconomic analysis.

Boom, Bust, and Macroeconomic Policy

People are drawn to historical analogies, and policymakers are no exception. Unfortunately, when they misunderstand the lessons of history, they usually end up prescribing “cures” that do more harm than good. Such is the case with the common misconception that high levels of government spending during World War II pulled the U.S. economy out of the Great Depression.

In fact, during the war Americans suffered numerous deprivations (including the outrage of conscription). Living standards didn’t recover until after the war ended, when vast amounts of labor and capital were released from military production and redeployed to the civilian economy.

Those who advocated increasing government spending to end the Great Recession of 2008–2009 often repeated the myth of the “Keynesian miracle” of World War II. This mistake, Higgs explains, stems in part from their overemphasis on the role that consumer spending plays in economic growth and their neglect of the importance of private investment and capital formation.

Labor Markets

Because unemployment is a leading concern people have about the economy, the periodic release of official labor-market data is often greeted with feverish anticipation. Employment statistics, however, are easy to misinterpret: some measures overstate joblessness and under-employment, whereas others understate them.

Moreover, Higgs explains, focusing on labor markets as a whole can foster false impressions about trends within subsets of labor markets demarcated by age, gender, industry, and other categories. Other misunderstandings, he shows, arise from looking only at recent employment trends and ignoring longer-term ones.

Libertarianism

Ten chapters in Taking a Stand address topics especially relevant to those who champion both economic and civil liberties. The first deals with an issue of supreme importance: war and peace. War-making, Higgs argues, is the state’s “master key,” effectively allowing it to open any and all doors and override all other concerns, including people’s most basic rights. Opposing war is therefore an imperative for all who claim to cherish liberty.

Other chapters look at the need to invoke moral principles when campaigning for liberty; how the expansion of government programs makes it harder for people to see the path toward self-reliance; the impossible dream of classical liberalism; why the precautionary principle counsels us to renounce statism; and the need for freedom’s advocates to avoid in-fighting.

Remembrances of Parents, Teachers, Colleagues, and Comrades

Taking a Stand is Robert Higgs’s most personal work, and this is especially true when he discusses fifteen individuals—personal heroes who left an indelible mark on his life and people whose work helped inspire his own. Some are famous and some are not, but all possessed a unique greatness that Higgs illuminates with his engaging storytelling.

The best known are the scholars Murray Rothbard, James M. Buchanan, Anna J. Schwarz, Thomas Szasz, and Robert Fogel. But Higgs’s most moving profiles are those of his parents, Oklahoma natives William and Doris Higgs, remembrances that shed light on the development of his sensibilities and convictions.

Just for Fun

Until the final section, Higgs treats his subject matter with utmost seriousness, but he closes Taking a Stand by sharing his efforts at light-hearted verse. Poking fun at academic economics in general and Keynesian doctrine in particular, Higgs remakes works by Edgar Allen Poe, Don McLean, and even Bobby “Boris” Picket.

As is always the case with Higgs, the results are both stylish and substantive. Here is playful poetry that manages to nourish the mind and tickle the funny bone.

* * *

No scholar in recent times has exposed the causes and consequences of the U.S. government’s misbehavior with more academic clarity and pitch-perfect flair than Robert Higgs. Taking a Stand continues this enviable record, often in a casual style. In his Foreword to the book, Judge Andrew P. Napolitano writes, “Be prepared for Bob with his hair let down; for here are essays that show a whimsical, introspective, and personal Bob Higgs. And be prepared to learn more wisdom in five pages than what other authors convey in five books."

Praise

“Robert Higgs begins Taking a Stand by thanking his students. But his list is much too short, for we are all his students. Often funny, and usually subversive of the conventional wisdom, this book spans a short period (2009-14) in Bob’s marvelously productive life. Chapters range from serious engagements with economic affairs to heartfelt eulogies—Bob’s ‘goodbye’ to Manuel Ayau cannot be read without tearing up—to parodies of the rock song ‘American Pie’ and the poem ‘The Raven.’ It is hard to convey the depth and value of this timely yet timeless book. But if Francis Bacon could be crossed with P.J. O’Rourke, that would come close.”

—Michael C. Munger, Professor of Political Science, Economics and Public Policy, and Director of the Philosophy, Politics, and Economics Program at Duke University

“More than anyone in our time, Robert Higgs wrestles with ‘James Madison’s Dilemma,’ that is, if we have created a government powerful enough to protect our rights and liberties, what is to prevent it from taking away those very rights and liberties? One may not agree with all of his recent musings in Taking a Stand, but they are invariably thought-provoking and admirable.”

—Richard E. Sylla, Henry Kaufman Professor of the History of Financial Institutions and Markets, New York University

“In his latest book Taking a Stand, Robert Higgs laments that his mother should not have let him become an economic historian. That’s the only error he makes in 99 pithy chapters that debug a virtual database of statist fallacies for government controls. For example, World War II is not proof that astronomical government spending fixed the economy after decades of New Deal spending failed—but it is proof that when one-fifth of the population is forced to fight in a war or to work to support the war effort, the statistical unemployment rate goes down. Everyone interested in freedom should read this book to understand clearly how economic reasoning and political realism apply to ongoing debates over the ever-increasing control that government exerts on our lives.”

—T.J. Rodgers, Founder, President and Chief Executive Officer, Cypress Semiconductor Corporation

“No voice today for peace and liberty is as clear, as consistent, as learned, as insightful, and—this is important—as passionate and resonant as that of Robert Higgs. The pages of Taking a Stand prove me correct.”

—Donald J. Boudreaux, Professor of Economics and Director of the Center for the Study of Public Choice, George Mason University; Co-Editor, Café Hayek

“Robert Higgs has been pounding Leviathan since before most of today’s libertarians were born. He has awakened new generations of students to the perils of unleashed politicians and lawless bureaucrats. In Taking a Stand, his passion and principles continue to fire folks up to stand up for their rights and liberties.”

—James Bovard, author, Freedom in Chains, Lost Rights, and Terrorism and Tyranny

“Robert Higgs writes with passion and wit. No one cuts to the chase with more precision. Higgs’s engaging style makes Taking a Stand a pleasure to read.”

—Lee J. Alston, Ostrom Chair, Professor of Economics, and Director of the Vincent and Elinor Ostrom Workshop in Political Theory and Policy Analysis, Indiana University

“In Taking a Stand, Robert Higgs dissects the myth of democratic government, juxtaposing it with the realities of the nation state and its systematic accretion of power, perquisites of office, and control over assets. He strips away comforting illusions of the beneficence of government, pointing out that customary justifications for its existence often conceal a lust for control. He explores the nature and legitimacy of government, its tactics and motivations, and the uncertainty and risks it injects into economic choices of the governed, with specific reference to the prospects for economic recovery in the current political environment. The book is highly readable and accessible to non-economists.”

—Charlotte A. Twight, Professor of Economics, Boise State University

“Full of fascinating insights, Taking a Stand illuminates Robert Higgs’s life-long search for the true causes of economic and social problems, by utilizing all possible means: theory, history, literature, and his own experience. Higgs’s emphasis on the crucial value of liberty has substantial implications for the future role of government in Asian countries and worldwide.”

—Yuzo Murayama, Professor and Vice President, Doshisha University, Japan

“With immensely readable vignettes from a life well lived, Robert Higgs’s Taking a Stand is a wonderful book.”

—Julio H. Cole, Professor of Economics, Universidad Francisco Marroquín, Guatemala