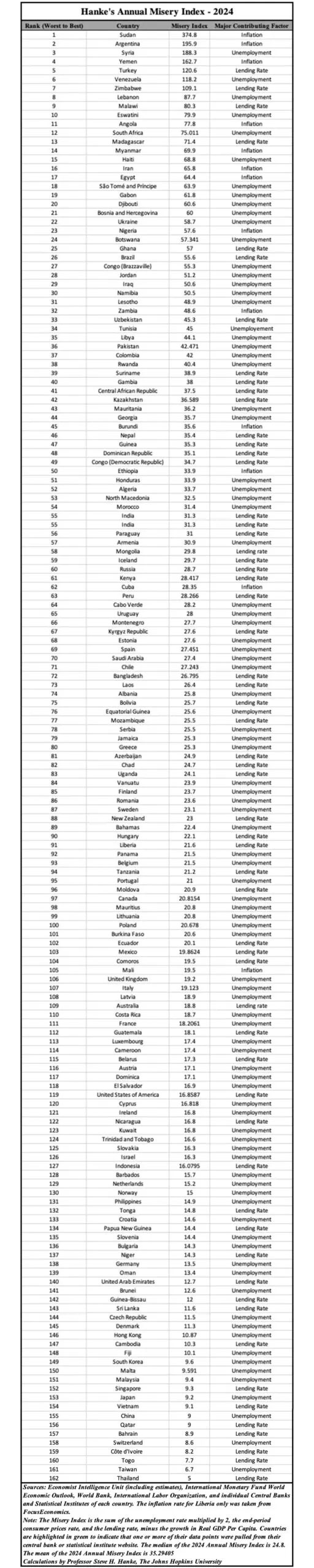

Each year, I produce Hanke’s Annual Misery Index (HAMI). By using readily available economic data, I can measure the temperature of the patient, so to speak, to determine just how “miserable” or “healthy” an economy is.

The idea of a misery index was fathered by Arthur Okun, a distinguished economist who served as chairman of the President’s Council of Economic Advisers from 1968 to 1969 during President Lyndon B. Johnson’s administration. Johnson wanted an easy way to take the economy’s temperature. Okun’s index, which he used for the United States, is equal to the sum of the inflation and unemployment rates.

Okun’s misery index was modified by Harvard professor Robert Barro in 1996, by including the 30-year government-bond yield and the difference between the long-term-trend rate of real GDP growth and the actual rate of real GDP growth. Barro used his index to measure the state of the economy during a U.S. president’s term.

In 2009, I amended Barro’s version of the misery index by replacing the 30-year government-bond yield with lending rates, and by replacing the difference between the long-term-trend rate of real GDP growth and the actual rate of real GDP growth with the growth rate of real GDP per capita.

Then, in 2022, I made a further amendment to HAMI. Following Andrew Oswald’s suggestion, I decided to double the weight put on the unemployment-rate component in HAMI. The intuition is that an additional percentage point of unemployment hits people a lot harder than an additional percentage point of inflation. So, HAMI is the sum of the year-end unemployment (multiplied by two), inflation, and bank-lending rates, minus the annual percentage change in real GDP per capita. Some might protest that the inflation rate and bank lending rate are correlated, and therefore the HAMI double-counts the effective inflation. Similar to the doubling of the unemployment weight, this is by design. The logic for this is rooted in loss aversion: People perceive losses as more significant than gains. That’s why the growth rate of real GDP per capita is not double-weighted.

Unlike Okun and Barro, who focused on the United States, HAMI covers many foreign countries; 162 are included in the 2024 edition.

The 20 countries that are most miserable in 2024 are roughly the same rogue’s gallery as in 2023. Indeed, 15 of the 20 most miserable countries are the same, with Tonga, Pakistan, Bosnia and Herzegovina, Ukraine, and Suriname departing and Eswatini, Madagascar, São Tomé and Príncipe, Gabon, and Djibouti joining. At the happy end of the HAMI distribution, 15 of the 20 least miserable countries also remained the same in 2023 and 2024, with Belgium, Mali, Germany, Oman, and the Netherlands departing and Sri Lanka, Czech Republic, Cambodia, Singapore, and Vietnam joining.

The ten most miserable countries in the world in 2024, listed by descending rank order, were Sudan, Argentina, Syria, Yemen, Turkey, Venezuela, Zimbabwe, Lebanon, Malawi, and Eswatini. I highlight the first three.

Sudan takes this year’s prize as the most miserable country in the world. Thanks to the outbreak of the Sudanese civil war on April 15, 2023, Sudan ranked sixth in my 2023 Misery Index. Now, as the war has progressed through its second year, Sudan has understandably taken the top spot.

Mediation efforts between the war’s two parties—the Sudanese Armed Forces and the Rapid Support Forces—have continually failed, and to date, the war has claimed 150,000 or more lives and displaced over 8.2 million people. Mass unemployment (58 percent) has followed, and due to the rapid depreciation of the Sudanese pound, the annual inflation rate has hit 204.7 percent per year.

Sudan’s HAMI = [(Unemployment (58%) * 2) + Inflation (204.7%) + Bank-Lending Rate (26.8%)]—Real GDP Growth (-27.3%) = 374.8

Argentina ranks as the second-most miserable country in 2024. President Milei campaigned on the promise to kill inflation by mothballing both the Argentine central bank and peso, putting them in a museum, and replacing them with the U.S. dollar. It seemed as though he had learned one big lesson: to become credible and gain the public’s trust, inflation must be crushed.

But once in office, Milei shelved dollarization, promising that it would arrive at some future, unspecified date. Apparently, Milei was spooked by the International Monetary Fund, Argentina’s largest creditor, as well as by his own advisers, who claimed that dollarization was not feasible without the receipt of a large loan because Argentina didn’t have enough foreign-exchange reserves to dollarize.

That being said, Milei has done a lot of good in Argentina. Thanks to his progress in dismantling Argentina’s fascist economic system, the Argentine stock market is up 124 percent since Milei took office, and his approval rating is higher than former President Alberto Fernandez’s in 2023 across every level of the income distribution.

However, Milei has failed to fulfil his campaign promise. As a result, he has been unable to rein in the growth of Argentina’s money supply. It’s surging at 169 percent per year. Until Milei controls the money supply, he is living on borrowed time.

Argentina’s HAMI = [(Unemployment (7.2%) * 2) + Inflation (118%) + Bank-Lending Rate (60.6%)]—Real GDP Growth (-2.7%) = 195.9

Civil war seems to be a theme among this year’s most miserable countries. Syria, not surprisingly, is right up at the top of the list. We should expect a country embroiled in civil war for over 14 years now to be lacking in happiness. The fact that Argentina is accompanied by two countries embroiled in civil war speaks volumes about the hole the outgoing Peronist administration dug for President Milei.

Syria’s HAMI = [(Unemployment (55%) * 2) + Inflation (60%) + Bank-Lending Rate (13.9%)]—Real GDP Growth (-4.4%) = 188.3

The ten happiest countries in the world in 2024, listed by ascending rank order, were Thailand, Taiwan, Togo, Côte d’Ivoire, Switzerland, Bahrain, Qatar, China, Vietnam, and Japan. Again, I highlight the top three happiest countries.

Thailand is this year’s happiest country. The Bank of Thailand’s mandateis to “foster a stable, sustainable and inclusive macroeconomic and financial environment.” Clearly, when it comes to unemployment and inflation, the Bank of Thailand knows what it’s doing. Contrary to the (questionable) Phillips Curve logic, it has somehow been able to engineer strong growth (2.6 percent) and remarkably low unemployment (1 percent) while keeping inflation down to a meager 1.1 percent per year.

Thailand’s HAMI = [(Unemployment (1%) * 2) + Inflation (1.1%) + Bank-Lending Rate (4.5%)]—Real GDP Growth (2.6%) = 5

Taiwan’s economic performance has been strong across the board. As the arithmetic below shows, the “bads” were minimized, and the “good,” was, well, pretty good (5.7 percent per year real GDP growth). Threats from China notwithstanding, Taiwan’s economy is firing on all cylinders.

Taiwan’s HAMI = [(Unemployment (3.3%) * 2) + Inflation (2.1%) + Bank-Lending Rate (3.2%)]—Real GDP Growth (5.2%) = 6.7

Togo has consistently been one of the world’s happiest countries since its inclusion in my Misery Index in 2020. Its use of the CFA Franc, which happens to be the most robust currency in Africa, has kept inflation to a reasonable 2.7 percent per year. Further, Togo’s cozy relations with China have kept Togolese employed. Indeed, China invited Togo to join the Belt and Road Initiative in 2018, and Chinese President Xi Jinping met withTogolese President Faure Gnassingbe in 2024. As a result, China has been “deeply involved” in infrastructure projects in Togo that seem to be keeping Togolese happy.

Togo’s HAMI = [(Unemployment (1.9%) * 2) + Inflation (2.7%) + Bank-Lending Rate (5.5%)]—Real GDP Growth (4.3%) = 7.7

While the list of the top ten happiest countries might not comport with readers’ expectations, good numbers are good numbers, at least for now.